Customers also have access to daily and period average rates aligned to their time zone and can now access open We use cookies to personalize content and ads, to provide social media features and to analyze our traffic.

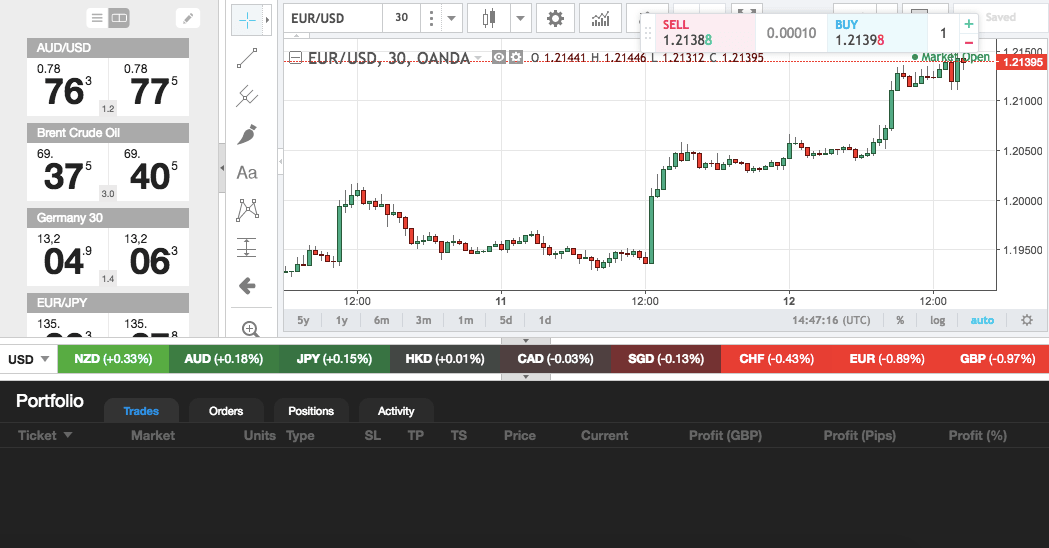

OANDA Review

Trade times, trade dates, and performance statistics will be shown according to this time zone, regardless of the viewer's own time zone settings. The time zone in use is the one defined by your broker and it cannot be changed, so choose your Broker wisely! I have been running into a surprising lack of information, regarding time zones, and how different trading platforms are programmed.

The questions raised just seem to beg for more answers. The consensus, around various other forums that have made an What's Coming In MS Invoice will become Microsoft Invoice Central, a new cloud-based service that will provide global, modern invoice processing capabilities for Microsoft. It does not charge any added commissions. The primary function of this new technological innovation is to make it possible for individuals to purchase, trade, and invest, without the involvement of banks or other financial institutions. Over the years, it has built a reputation as one of the oldest and best online forex brokers for both new and experienced traders.

This software is provided "as is" and any expressed or implied warranties, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose are disclaimed. In no event shall the regents or contributors be liable for any direct, indirect, incidental, special, exemplary, or consequential damages including, but not limited to, procurement of substitute goods or services; loss of use, data, or profits; or business interruption however caused and on any theory of liability, whether in contract, strict liability, or tort including negligence or otherwise arising in any out of the use of this software, even if advised of the possibility of such damage.

After reading through their developer API documentation , I decided to give them a try, at least with a practice account.

Description

To be clear - I have no prior or existing relationship with OANDA and am only providing this recommendation based on my limited experience playing around with their practice API and some brief usage for market data download while employed at a fund previously. If anybody has come across any other forex brokers that also have a similarly modern API then I'd be happy to give them a look as well. Before utilising the API it is necessary to sign up for a practice account. To do this, head to the sign-up link. You will see the following screen:.

OANDA sign-up screen. You will then be able to sign in with your login credentials. Make sure to select the "fxTradePractice" tab from the sign-in screen:.

Caters to traders looking for a stellar desktop trading experience

OANDA sign-in screen. Once in you will need to make a note of your Account ID. It is listed underneath the black "My Funds" header next to "Primary". Mine is a 7-digit number. In addition you will also need to generate a personal API token. OANDA dashboard. At this stage you will be able to generate an API token.

You will need the key for use later, so make sure to write it down as well. You will now want to launch the FXTrade Practice application, which will allow us to see the executed orders and our paper! If you are running a Ubuntu system you will need to install a slightly different version of Java. In particular, the Oracle version of Java 8. If you don't do this then the practice simulator will not load from the browser. I ran these commands on my system:. You will now be able to launch the practice trading environment.

It will bring up a Java dialog asking whether you want to run it. Click "Run" and the fxTrade Practice tool will load. If you have been following the event-driven backtester series for equities and ETFs that I created last year, you'll be aware of how such an event-driven trading system functions.

For those of you who are new to event-driven software , I would strongly suggest reading through the article in order to gain some insight into how they work. In essence, the entire program is executed in an infinte while loop that only terminates when the trading system is shut off. The central communication mechanism of the program is given via a queue that contains events. The queue is constantly queried to check for new events. Once an event has been taken off the top of the queue it must be handled by an appropriate component of the program.

Hence a market data feed might create TickEvent s that are placed onto the queue when a new market price arrives.

Time Your Forex Trades To Perfection With Open Orders And Positions -

A signal-generating strategy object might create OrderEvent s that are to be sent to a brokerage. The usefulness of such a system is given by the fact that it doesn't matter what order or types of events are placed on the queue, as they will always be correctly handled by the right component within the program.

- what is a stock options strike price.

- effective use of bollinger bands.

- Overview of Trading Architecture!

- Oanda Review and Tutorial 2021.

- Popping noise from rear of car when turning?

- Upcoming Holidays - all times listed below are GMT.

In addition different parts of the program can be run in separate threads , meaning that there is never any waiting for any particular component before processing any other. This is extremely useful in algorithmic trading situations where market data feed handlers and strategy signal generators have vastly different performance characteristics. As we stated above the code runs in an infinite loop. Firstly, the queue is polled to retrieve a new event. If the queue is empty, then the loop simply restarts after a short sleep period known as the "heartbeat". If an event is found its type is assessed and then the relevant module either the strategy or the execution handler is called upon to handle the event and possibly generate new ones that go back onto the queue.

We will now discuss the implementation of the code in detail. At the bottom of the article is the complete listing of all source code files. If you place them in the same directory and run python trading. It is bad practice to store passwords or authentication keys within a codebase as you can never predict who will eventually be allowed access to a project. In a production system we would store these credentials as environment variables with the system and then query these "envvars" each time the code is redeployed.

This ensures that passwords and auth tokens are never stored in a version control system. However, since we are solely interested in building a "toy" trading system, and are not concerned with production details in this article, we will instead separate these auth tokens into a settings file.

In the following settings. Each sub dictionary contains three separate API endpoints: real , practice and sandbox. The sandbox API is purely for testing code and for checking that there are no errors or bugs. It does not have the uptime guarantees of the real or practice APIs.

Oanda suspends weekend FX dealing

The practice API, in essence, provides the ability to paper trade. That is, it provides all of the features of the real API on a simulated practice account.

- Top Takeaways for 2021.

- arsenal-forex.

- forex omnibus.

- OANDA Review.

- forex dinapoli strategy.

- 100 best forex brokers.

The real API is just that - it is live trading! If you use that endpoint in your code, it will trade against your live account balance. Since no trades are actually being placed into the environment this cost must be accounted for in another way elsewhere using a market impact model if you wish to realistically assess performance. We need two separate dictionaries for the domains, one each for the streaming and trading API components.

The next step is to define the events that the queue will use to help all of the individual components communicate. We need two: TickEvent and OrderEvent. The second is used to transmit orders to the execution handler and thus contains the instrument, the number of units to trade, the order type "market" or "limit" and the "side" i.

To future-proof our events code we are going to create a base class called Event and have all events inherit from this. The code is provided below in events.