You have to somehow know that the primary trend is ready to take a breather.

In all my years of trading, one thing is constant, any surprises in price action are generally in the direction of the primary trend. The confirmation of the pattern can occur in two ways. The first one is to get another opposite candle on the chart. The second method is the confirmation candle is part of a reversal pattern. Notice that this rule will fail at times, since two opposite candles is not a strong confirmation signal. Other confirmation of the counter trend trade could be a candle, which completes a reversal candle pattern. This could be a single hanging man, or a shooting star on the chart.

However, the candle could also be the second candle of a double or triple bottom candle pattern. Then you get another candle, which engulfs the opposite candle from Step 1. If this happens, you will have an engulfing reversal pattern on the chart.

- weizmann forex card.

- countertrend.

- What is scalping in forex trading?.

Example 2: After the opposite candle on the chart, you get a candle, which is fully engulfed by the previous candle. In this case you will have a harami reversal pattern. In both cases, you will have a confirmation of the impulse reversal and hence confirmation that a counter trend move is beginning. Above you see an impulse move, followed by a counter trend.

DIFFERENT TYPES OF TRADING STRATEGIES

At the end of the impulse, the price action creates an opposite candle. Also, this candle engulfs the previous candle, which creates an engulfing reversal pattern. This gives us a bearish signal on the chart, which alerts us that a counter trend might emerge.

As you see, the price decreases to the bullish support line. No more panic, no more doubts. Learn About TradingSim If the general trend is bullish, then the expected counter trend move will be bearish. In this manner, you should open a short position. If the general trend is bearish, then the expected counter trend price move is bullish.

Scalping Counter Trend strategy - Indicators - ProRealTime

This means that you should open a long position. I recommend you always set a stop loss when you trade a counter trend price move. The proper location of your stop order is as follows:. Bullish Trend — Above the top between the trend impulse and the expected counter trend move.

Bearish Trend — Below the bottom between the trend impulse and the expected counter trend move. Now that we discussed how to confirm potential counter trend moves, when to enter the market and where to place the stop, we need to talk about how long you should hold your trade. The rule here is simple. You should hold your trade until the price action during the correction touches the general trend line. You should close your trade once this occurs.

Above is the 3-minute chart of Visa from July 6, The image illustrates a bullish trend and two counter trend trades. On the way up, the price action suddenly creates a bearish candle, which confirms the first step of our trading strategy.

Thus, we also confirm the second step of our strategy and the potential beginning of a counter trend move, therefore we open a short position in Visa. We place a stop loss right above the top created by the bearish candle. This is shown with the red horizontal lines on the image. The price then begins decreasing. Fifteen minutes after we short Visa, the price drops to its bullish trend line and we close the position. The price then bounces upwards and starts a new impulsive move higher; however, ten periods later the price action closes a bearish candle, fulfilling the requirements of step 1.

The bearish candle on the chart engulfs its predecessor, which means that we have a bearish engulfing pattern. Therefore, we receive confirmation for the emergence of a counter trend price move. This is another sell signal on the chart and we short Visa. Visa begins to decrease again after the beginning of the counter trend move. Eight periods later, the price action touches the bullish trend line on the chart, creating an exit signal.

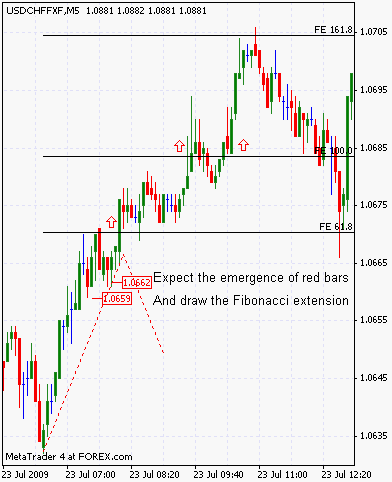

We should use this indication to close our trade and to collect the paper profit on the trade. In order to trade a potential counter trend move, you would need to know the end of the impulse and the beginning of the corrective move. To do this, you place the Fibonacci retracement on the previous price counter trend. Then you will use the Fibonacci extensions to identify the potential end for the impulsive price move. Fibonacci retracements can also be useful to confirm when to exit your counter trend trade. You do this by placing the indicator on the previous impulse move.

Then you use the standard Fibonacci levels to determine potential support areas for the price action, which you can use to exit your trade. Counter Trend Trading — Fibonacci Levels. This is the 3-minute chart of Google, a. Alphabet Incorporated from July 13, The image shows how Fibonacci levels help identify the beginning of a counter trend price move.

The prevailing trend of the above price action is bearish. The light blue bearish line on the chart indicates the bearish trend. First you have a counter trend move, followed by a bearish impulse.

Trading Mistake #1 – Limiting yourself to lower time frames only

The end of the impulse is the beginning of a new counter trend price move, which we attempt to trade. Total profit Share your opinion, can help everyone to understand the forex strategy. Peter Monday, 14 December I am making a lot of money with this system thank you. I am sending a donation.

3 Trading Mistakes To Avoid When Scalping The Forex

MohdAffiq Thursday, 20 August The technique is very useful. It would be much more beneficial if I could learn more from you. Rod Peter Wednesday, 12 February Thanks for sharing this simple yet quite profitable strategy! The indicators are very useful too. Trend Scalping System. Exit Position options: exit at the opposite arrow; exit on the pivot point levels ; exit with profit target predetemined. Comments: 3.