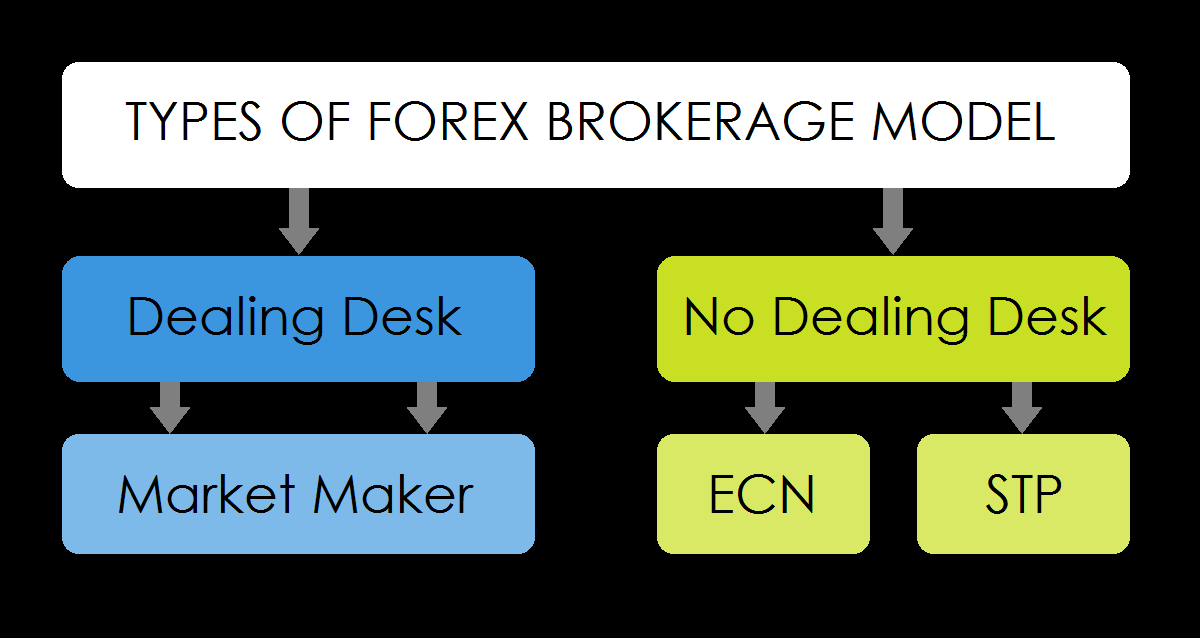

By the very name, they lack a dealing desk. A market provider is simply a facilitator of your order. It is passing the order through to the interbank real market, where other traders take the other side of your trade. They are just a service providers, simply providing service for facilitating. You are trading through them and not against them. Whereas with market makers you are trading against them, so if you profit, they lose and vice versa. No Dealing Desk NDD brokers can either charge a small commission on each trade or just choose to keep a markup by increasing the spread slightly.

STP brokers usually have many liquidity providers, with each provider quoting its own bid and ask price. If their liquidity providers widen the spread, they have no choice but to widen their spreads, too.

Comparison of Forex Broker Types: ECN, STP and Market Maker

Some STP brokers do offer fixed spreads, but most have variable spreads. In STP system, transactions are fully computerized and are immediately processed on the interbank market without the intervention of any broker. The Electronic Communications Network ECN is utilized by Forex brokers to provide direct access to its clients and other participants in the Forex market. It is an automatic system that combines the buy and sell order for securities. Participants include banks, hedge funds, retail traders, and even other brokers. Basically, participants trade against each other by offering their best ask and bid prices.

Because of the nature of ECN, it is very difficult to put a fixed markup, so ECN brokers usually make their money by charging a commission on the traded volume. For clients with a high volume of trading activity and large account balances, the ECN is obviously the best fit. If you thrive for employing scalping techniques, EA assistants, or automated trading robots, then undoubtedly an ECN environment is best suited for your needs.

- Recent Posts.

- forex price alert email?

- ECNs versus the Market Makers: Who’s the king of the hill?;

- systems engineering trade off analysis.

- Types of Brokers;

- ECN Brokers!

Furthermore, I encourage you to watch this video which takes a look at the risks of insolvency of these three types of brokers. Publish on AtoZ Markets.

Welcome to Mitrade

Get Free Trading Signals Your capital is at risk. Only Market execution.

Orders are facilitated by brokers. The broker is not a market maker or liquidity destination on the DMA platform it provides to clients. When traders want to sell, they buy from them, when traders want to buy, they sell to them Dealing desk brokers are able to profile their clients. They divide clients into groups systematically with algorithm. Losing trades of clients are counter-traded and become brokers' profit.

More losing traders means more profit for the broker. When traders buy , broker sell to them, then the broker buy the same amount in real market.

Best ECN Brokers – Our Expert Choices

This is also done automatically through algorithm. In this case, brokers will also make money through spread or commission. Fixed spreads Makes money through spreads and when a client loses a trade. Price Manipulation is possible. Transparency of dealing desk brokers differ depending on their own company rules. No re-quotes and no additional pausing when confirming orders.

Clients' orders are executed automatically, immediately and anonymously.

Comparison of Forex Broker Types: ECN, STP and Market Maker

There is no dealing desk watching you orders. Because all Participants or liquidity providers compete for prices in a real market. More LPs usually means more depth in the liquidty pool,thus better spreads. Traders usually get variable spreads. Number of Liquidity providers One Liquidity Provider. LP control the price spread. Maintenance costs is lower, but the broker become completely dependent on the one LP. Most STP Brokers has a predetermined number of liquidity providers. ECN brokers have a large number of liquidity providers. They add small mark-ups on the best bid and ask rates they get from LPs.

For example, adding a pip to the best bid price or subtracting a 0. Clients' orders are directly sent to a certain number of liquidity providers Banks or Other Brokers More liquidity providers means more liquidity and better fills for the clients. The fixed spreads they charge are higher than the best quotes they get from LPs. They may use their back-office price matching system to make sure they can make profits on spread difference while hedging the trades with LP s at better rates at the same time. Direct Market Access Forex DMA refers to electronic facilities that match orders from traders with bank market maker prices.