All around us we have the Major and the Minor in all things from music to stars, to the toes on your feet. At least I hope you have toes. All self similar in scale from small to large. Again in this chart I will point out visually point 5 is Also notice the two extreme volume bars at point 5 along with the extreme in the value charts indicator which would look the same if you use RSI CCI ect ect. One trick to note is the space between the bars in point 1 to 4 divided by 2 is around 8 bars.

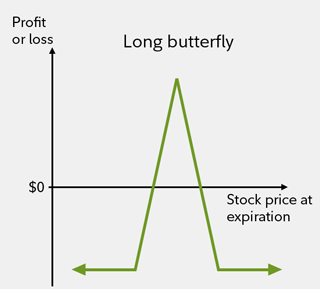

Just watch and count each time you notice a W or M formation on the charts. The iron butterfly spread is created by buying an out-of-the-money put option with a lower strike price, writing an at-the-money put option, writing an at-the-money call option, and buying an out-of-the-money call option with a higher strike price. The result is a trade with a net credit that's best suited for lower volatility scenarios. The maximum profit occurs if the underlying stays at the middle strike price.

The maximum profit is the premiums received. The maximum loss is the strike price of the bought call minus the strike price of the written call, less the premiums received. The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money call, and writing an out-of-the-money call at a higher strike price.

When to use Long Call Butterfly strategy?

This creates a net debit trade that's best suited for high-volatility scenarios. Maximum profit occurs when the price of the underlying moves above or below the upper or lower strike prices.

The strategy's risk is limited to the premium paid to attain the position. The maximum profit is the strike price of the written call minus the strike of the bought call, less the premiums paid. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is.

The amount of premium paid to enter the position is key. This scenario does not include the cost of commissions, which can add up when trading multiple options. A butterfly spread is an options strategy combining bull and bear spreads, with a fixed risk and capped profit. Each type of butterfly has a maximum profit and a maximum loss.

Episodes on Butterfly Spread

The long call butterfly spread is created by buying one in-the-money call option with a low strike price, writing selling two at-the-money call options, and buying one out-of-the-money call option with a higher strike price. The long put butterfly spread is created by buying one out-of-the-money put option with a low strike price, selling writing two at-the-money put options, and buying one in-the-money put option with a higher strike price. Advanced Options Trading Concepts. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

Iron Butterfly

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money.

Personal Finance. Your Practice. Popular Courses. Part Of. Basic Options Overview. Key Options Concepts. Options Trading Strategies.

How to trade "Butterfly Patterns" with Binary Options

Iron condors and butterflies are sort of in the same family, and have similar risk profiles. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please note that the examples above do not account for transaction costs or dividends. Orders placed by other means will have additional transaction costs. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success.

Everything You Need To Know About Butterfly Spreads

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

TD Ameritrade, Inc. All rights reserved. Body and Wings: Introduction to the Option Butterfly Spread Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. By Tom White July 31, 5 min read. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread.

Start your email subscription. Recommended for you. Related Videos.