How do I place a trade?

Foreign exchange market

Do you offer a demo account? How can I switch accounts? Search for something. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Forex Trading | TD Ameritrade

Home Learn Learn forex trading What is forex? Free demo account Practise trading risk-free with virtual funds on our Next Generation platform. The ability to trade on margin using leverage High levels of liquidity mean spreads stay tight which keeps trading costs low Prices react quickly to breaking news and economic announcements this can be a disadvantage too Trade 24 hours a day from Sunday to Friday The ability to go long and short Wide range of markets spread bet or trade CFDs on over forex pairs with CMC Markets.

You can lose all of your capital - leveraged forex trading means that both profits and losses are based on the full value of the position. The availability of leverage is one of the reasons that many people are interested in trading FX. Our accounts offer competitive margin rates on forex instruments starting at just 3.

“Long” and “Short”

Read more about forex vs stocks here. Test drive our trading platform with a practice account.

Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Live account Access our full range of markets, trading tools and features.

Open a live account. Demo account Try trading with virtual funds in a risk-free environment.

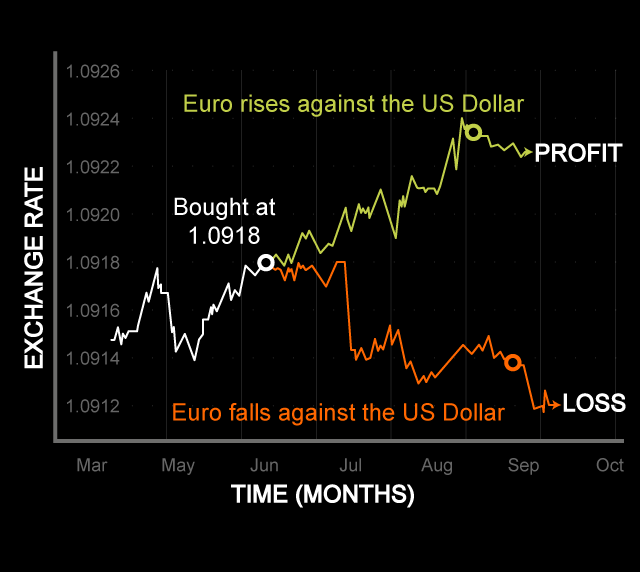

Demo account Trade with virtual funds in a risk-free environment. Sign up for free. Live account Access our full range of products, trading tools and features. Placing a trade in the foreign exchange market is simple. The mechanics of a trade are very similar to those found in other financial markets like the stock market , so if you have any experience in trading, you should be able to pick it up pretty quickly. The objective of forex trading is to exchange one currency for another in the expectation that the price will change.

More specifically, that the currency you bought will increase in value compared to the one you sold. An exchange rate is simply the ratio of one currency valued against another currency. The reason they are quoted in pairs is that, in every foreign exchange transaction, you are simultaneously buying one currency and selling another.

Whenever you have an open position in forex trading, you are exchanging one currency for another. The base currency is the reference elemen t for the exchange rate of the currency pair. It always has a value of one. The second listed currency on the right is called the counter or quote currency in this example, the U.

When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy ONE unit of the base currency. The base currency is the reference elemen t for the exchange rate of the currency pair. It always has a value of one. The second listed currency on the right is called the counter or quote currency in this example, the U. When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy ONE unit of the base currency.

In the example above, you have to pay 1. When selling, the exchange rate tells you how many units of the quote currency you get for selling ONE unit of the base currency. In the example above, you will receive 1.

- What is forex and how does it work?.

- Forex Market.

- Your Trade. Your Platform..

- 2021 Overall Ranking.

- What Is Forex Trading?.

- forex trading islamic.

- How to Make Money Trading Forex;

The base currency represents how much of the quote currency is needed for you to get one unit of the base currency. With so many currency pairs to trade, how do forex brokers know which currency to list as the base currency and the quote currency? Just know that this is a matter of preference and the slash may be omitted or replaced by a period, a dash, or nothing at all.

They all mean the same thang.