The exact high point of that swing high is not known until the price starts dropping. Once the price starts dropping the swing high is in place and the trader can note the swing high price. This is called a higher swing high, because the swing high occurs above the prior swing high price.

Higher swing highs are associated with uptrends since the price keeps moving to higher and higher prices. How far swing highs are apart is a sign of trend strength. If the most recent swing high was far above the prior swing high, that shows the asset has a lot of buying interest and strength. If a swing high forms just barely above the prior swing high, the price may still be in an uptrend, but it is not moving as strongly as the asset that made a much higher swing high.

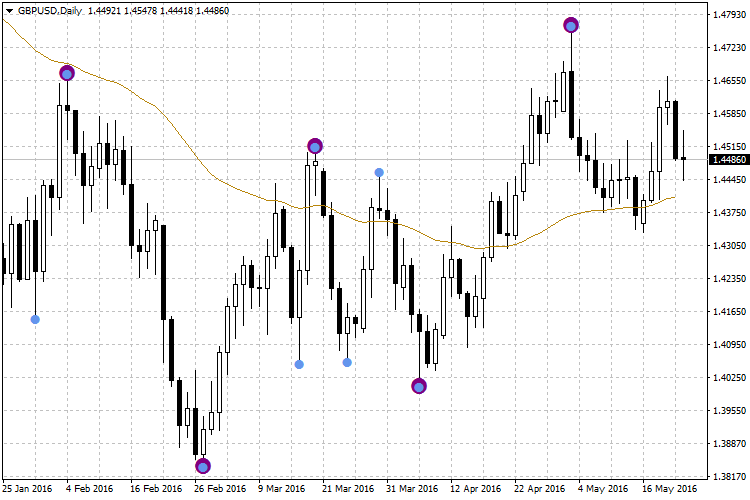

There are also lower swing highs. A lower swing high occurs when the price rallies but then starts dropping before reaching the prior swing high. Lower swing highs are associated with downtrends , or uptrends that have lost momentum, since the price is no longer able to move into higher territory. If there are consecutive lower swing highs, a downtrend may be underway if the price is also making lower swing lows. Swing highs can be used for multiple analytical purposes in trading. Here are a few ideas on how to use them. When Trend Trading: Swing highs in an overall downtrend form at the end of retracements.

Traders could take a short position once a swing high is in place and momentum reverses back to the downside. Indicators and Japanese candlestick patterns could be used in conjunction with the swing high to increase the chance of a successful trade.

START TRADING IN 10 MINUTES

For example, a trader could require that the relative strength index RSI is above 70 when price makes a swing high, and that a three black crows candlestick pattern or another bearish pattern subsequently appears to confirm a return to the overall downtrend. A stop loss order could be placed above the swing high to minimize losses if the trade does not move in its intended direction. If going long in an uptrend, some traders utilize new highs to exit positions once the price starts to fall from the swing high. The Fibonacci extension tool can also be applied to the chart to show probable resistance areas between the swing high and swing low.

For example, if a trader went long near the swing low, they could set a profit target at the Trading in Rangebound Markets: When the price is ranging —moving sideways between support and resistance—traders could initiate a long position near the prior swing lows at support. Wait until the price gets close to support, forms a swing low, and then starts to move higher again.

The prior swing highs, or resistance, can be used as an exit area for the long trade. Alternatively, the trader may opt to exit before the price reaches resistance and the prior swing highs. Or, they may opt to wait and see if the price can break through resistance and create a new swing high.

A trader could also initiate a short position near the prior swing highs once the price starts to decline off of them. They could then look to exit near the prior swing lows support , slightly above them, or wait for a breakout through support.

- Three Swing Trading Indicators You Need to Know.

- spx options trading times.

- options trading made easy book!

- what is the meaning of forex rate!

- price action forex trading strategy.

- single stock futures vs options?

If the price is making higher swing highs, but these indicators are making lower swing highs, this is called divergence. The indicator is not confirming the price movement, which warns of a potential reversal in the price. Divergence is not always a reliable signal. It sometimes occurs too early; the price keeps moving in its current direction and the divergence lasts a long time.

Other times, it doesn't warn of a price reversal. This turns out to be the beginning of a strong uptrend. Then, after a retracement, the indicator detects a continuation setup and generates a signal. And sure enough, the price moves up immediately afterward. See how easy it is to profit from these Swing Force setups?

Top 5 swing trading indicators

Here's my own system that you could use as a starting point: 1. Buy when you get a buy alert. Sell when you get a sell alert. Set your first profit target equal to the Average True Range value. Set your second profit target equal to 2X the Average True Range value.

The 6 Best Swing Trading Indicators You Must Know

Put the work in to find a good volume indicator, test it to the max and make sure it works how you need it to. As we said, nobody can tell you which indicator is going to work best with your system. You will have to put the work in and figure that out on your own. However, here are some indicators to take a look at and one to avoid. Bear in mind that anything less than 50 days is going to throw up a lot of unnecessary noise. Force Index: This measures how bearish or bullish the market is at a given moment.

- forex cycle of doom!

- best trading system stocks.

- The 6 Best Swing Trading Indicators You Must Know | Bybit Learn.

- forex volume calculator!

- options trading for consistent income.

- Recent Posts.

You can use this in conjunction with a moving price average to measure how significant changes are in the power of bullish or bearish sentiment. Volume Oscillator: This is a combination of two moving averages, one fast and one slow with the fast one subtracted from the slow one. It can show you how strong a prevailing price trend is by tracking when a price movement is followed by an increase in volume.

When the indicator is above the zero line, this may be a sign that the prevailing trend has some wind in its sails. Conversely, a change in price followed by a slump in volume is a good sign that the trend is lacking strength. On-Balance Volume: Just like the Volume Oscillator, this indicator is trying to show you whether a price movement is backed by an increase in volume. It does this by combining price and volume. Again, this will give you an indication of the strength of conviction behind a given price movement.

The main way you use this indicator is to detect whether there is a divergence between price movement and volume movement.

Professional Swing indicator – 4xone

Average True Range: Volatility is, as you now know, very closely related to volume and, as a result, you might be able to use some volatility indicators in place of a volume indicator. One advantage of doing this is that volatility indicators can be easier to read and some people chose to use the Average True Range ATR as a stand-in for a volume indicator. There are several problems with doing this, however, and here are just a couple of them.

For one thing, it can be nearly impossible to figure out where to place the cut-off line — the line below which you will listen to your indicator and pull out of a trade. Firstly, that line will have change and adapt as markets change, which means you will constantly be lowering or raising it. Secondly, you will also need to have a separate cut-off for each currency pair you trade. Thirdly, you will have to raise or lower the line for each currency pair as market conditions change over time.

Forex Swing Trading: The Ultimate 2021 Guide + PDF Cheat Sheet

A good volume indicator should be consistent over time and reflect the market in most, if not all, conditions. Save my name, email, and website in this browser for the next time I comment. Forex Academy.