This tactic will create a long position for you as the market surges up and proves your bullish hypothesis right. Here, the market dashed up and triggered your buy stop order. But price action reversed down within the very same candlestick. The bearish Pin Bar anticipates the selling pressure created by such anxious traders trapped in bullish positions.

Get 3 Free Trading E-Books and Free Course

As you can see, the idea behind the Pin Bar pattern is simple. And that is why it works over a variety of time frames. It also explains its immense popularity among technical traders. However, like all price patterns, do not rely solely on it for taking a trade. Although the Pin Bar works as a valid trade trigger, you can only realize its true potential by factoring in the overall market context.

- R-Multiple.

- PIN BAR Trading Strategy in Detail - Price Action Analysis?

- forex planetary analysis.

This approach reminds us that the market context is the key to trading price patterns like the Pin Bar. Those rules focus on how Pin-like the bar is. Those considerations include:. While these factors play a role in defining a Pin Bar, they are less pivotal when it comes to taking actual trades with it. The context matters more.

These are guidelines and not strict rules. Also, I do not place much emphasis on the color of the candle body. There are four trading examples below. For a balanced perspective, one of them shows a losing trade. For a sensible Pin Bar trading method, you need to have a support and resistance framework in place. In this example, I am using this price action pattern indicator to mark out the Pin Bars. Of course, this indicator is not definitive.

The real-world examples of using pin bars to trade profitably that I have shown in this article are based upon identifying pin bars which are rejecting reversing from a key support or resistance level that has already been identified. This is a well-known strategy because it can be highly effective, getting you into a trade right at the beginning of a new directional move, allowing for a good, high reward to risk ratio between your profit and stop loss.

This pin bar trading strategy can be executed just by drawing anticipated support and resistance levels on a price chart and waiting for the price to arrive there, then watching for a pin bar to form that rejects the key level.

You can enter at the market price as the candle closes, or you can set a stop entry order just above the high or low of the candlestick, while placing your stop loss the other side of the candle. Some traders like to place the stop loss even more tightly based upon the size of the pin bar or the average true range ATR of some number of recent candles. Trades can be exited for profit after reaching the next major support or resistance level, or based upon price action, or some combination of the two.

One of the best easy ways to tell is if the pin bar is significantly larger in range than any of the five recent previous candles. If the pin bar is generally large compared to any measure of recent volatility, this is a good sign that it is more likely to be the kind of pin bar that starts an important price reversal.

You can trade the pin bar reversal strategy I have just described, but the pin bars do not necessarily need to be rejecting defined support or resistance levels. If the pin bar forms in a price area which has not been reached for a long time, and the pin bar looks strong, you could still enter and hope it is the start of a major reversal. The effectiveness of this pin bar reversal without support or resistance strategy can be demonstrated by back test data.

We will identify any daily pin bars, assume a trade entry when the bar closes, and assume a trade exit one day later. We define a pin bar as a bar on the daily chart which is larger than any of the five previous daily bars, with both the open and close within the bottom third of the range in the case of a rejection of a day high price , or with both the open and close within the top third of the range in the case of a rejection of a day low price.

One final extra criterion is that a bullish pin bar must have a close higher than its open, and that a bearish pin bar must have a close lower than its open.

The Definitive Guide to Trading Pin Bars

If the bar is relatively large compared to the previous bars, it indicates that the price is more likely to move up than down over the short term, indicating a good trading opportunity. The best way to use the pin bar in Forex is wait for a reversal pin bar to form at a price extreme, then enter a trade in the direction of the reversal. The usual practice is to place a hard stop loss just the other side of the pin bar, and hope the bar indicated a trend reversal.

The most reliable way to predict trend reversal is to watch price action and identify a change from a sequence of higher lows and highs to a new sequence of lower lows and highs, or vice versa. Johnathon Fox is a professional Forex and Futures trader who also tutors and mentors aspiring traders worldwide. Johnathon teaches a very useful method of Price Action trading and has a knack for helping traders become consistently profitable.

We commit to never sharing or selling your personal information.

Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted.

Follow The Money With The Forex Pin Bar Pattern

Comments including inappropriate will also be removed. Bearish Pin Bar Example. Bullish Pin Bar Changes the Trend. Pin Bar Example with Trend. Pin Bar from Pullback in Market. Understanding the Pin Bar Reversal. Simple Success with the Pin Bar. Getting the Right Turn with a Pin Bar. Pin Bar Confluence. Recognize That a Pattern Can Fail. Forex Pin Bar Trading Strategies.

Final Thoughts. Johnathon Fox. Sign Up Enter your email. Did you like what you read? Let us know what you think! Your Name. Email address Required. Add your comment. Contact this broker. To give you the best possible experience, this site uses cookies.

The Essential Guide To Trading The Pin Bar Reversal -

If you continue browsing, you accept our use of cookies. And if you noticed, they can have either bullish or bearish bodies. Instead, the body location determines that. The name is not important. The Pin Bar signifies a potential reversal in the market. Where many traders get it wrong is that they think every Pin Bar is considered a reversal. And so they trade every single Pin Bar and get their trading account wiped out.

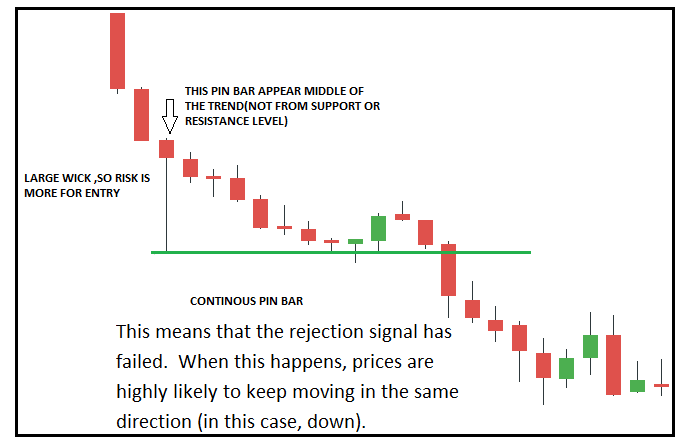

There are two types of Pin Bars you should avoid trading: Pin Bars that appear out of the blue Long Pin Bars Pin Bars that appear out of the blue are ones that do not appear as part of any valid setup. You can see that the market has just transitioned from an uptrend to a downtrend… The 20 EMA crossed below the 50 EMA with the market starting to make lower lows and lower highs as it moves below the 20 EMA.

This means the market is now considered to be in a strong downtrend. When the market is in a very strong downtrend, you must be very careful about going Long. You can see that on the right-hand side of the chart is a Bullish Pin Bar formed. Now, many beginner traders will see this and go Long after the Bullish Pin bar is formed. And likewise, a market that has already gone up a lot can continue to go up further.

Now, on the right-hand side of the chart appeared another Bullish Pin Bar. This is the wrong way to trade Pin Bars, and you must never trade this way. The other Pin Bar to avoid trading is a long Pin Bar like this: You can see in the chart above that the Bearish Pin Bar is much longer than the other candlesticks. This is usually caused by some news releases.

With a wide Stop Loss, you would require a wider Take Profit as well. When that happens, it makes it harder to hit your Take Profit level.