The rationale behind the mean-reverting process is that there exists a long-term equilibrium mean for the spread. The investor may bet on the reversion of the current spread to its historical mean by selling and buying an appropriate amount of the pair of the stocks. As 5 shows, one expects the returns of stocks and to track each other after controlling for proper. This model suggests an investment strategy in which one goes long 1 dollar of stock and short dollars of stock if is small. Conversely, if is large, one takes an opposite strategy that goes short and long. As a result, the return of the long-short portfolio may oscillate around a statistical equilibrium.

In real-world practice, the return of the long-short portfolio above for a period of time may be calculated as follows: where and denote the price of stock where we are long at time and , respectively; and and denote the price of stock where we are short at time and , respectively. The pairs-trading method can be generalized to a group of stocks in which mispricing may be identified through a proper combination of assets whose time series is mean-reverting.

Mean reversion in the equation above refers to the assumption that both the high and low prices of the synthetic asset are temporary and that its price tends to move toward its average price over time. Let be the price of a stock at time. The moving average at time , the mean of the prices corresponding to the most recent time periods, is defined as. In this study, we employ the Bollinger Bands [ 24 ] to determine if the spread of a pair of stocks departs from its dynamic average value. Typically, the Bollinger Bands prescribe two volatility bands placed above and below a moving average, in which volatility may be defined as a multiple of the standard deviation of the prices in the past.

Formally the Bollinger Bands can be defined as follows: where is the standard deviation of the prices, at time , over the past time periods; is a parameter used to control the width of the upper and lower bands to the moving average. An important component of a successful trading system is to construct models for market timing that prescribe meaningful entry and exit points in the market. In this study, we will use the moving averages and Bollinger Bands to develop a trading system, which is described in the next subsection.

In this work, we designate the trading strategy for one to buy sell the spread right after it gets standard deviations below above its mean value and the position is closed right after the spread gets closer than standard deviations to its mean, where and. Here we evaluate the performance of a trading system in terms of its compounded return, which is to be determined by the relevant parameters of the trading models employed.

Developing Trading Strategies with Genetic Algorithms by JayJayD -

We first define the return of a trading system for the th trade as , where denotes the set of the model parameters. Then the performance metric we use here is through the total cumulative compounded return, , where is defined by the product of the returns over consecutive trades as Therefore, in the process of capital growth, the capital at the end of trades is where represents the initial capital.

Given the market timing and pairs-trading models, the performance of a trading system shall be enhanced by suitable values of the corresponding model parameters. For the market timing models, the parameters include the period for the moving average and parameters and for the Bollinger Bands that controls the multiples of the standard deviations of the moving average for entry and exit points.

In this study, we propose using genetic algorithms GA for the search of optimal parameters of the trading system. We will describe the basics of GA as well as our proposed optimization scheme in the following. Genetic algorithms [ 25 ] have been used as computational simulation models of natural evolutionary systems and as adaptive algorithms for solving complex optimization problems in the real world.

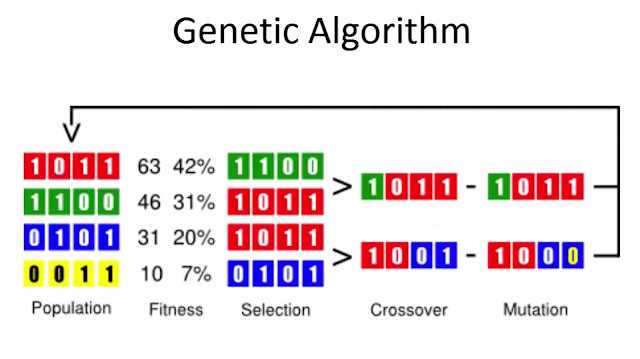

The core of this class of algorithms lies in the production of new genetic structures, along the course of evolution, that provide innovations to solutions for the problem. Typically, the GA operate on an evolving population of artificial agents whose composition can be as simple as a binary string that encodes a solution to the problem at hand and a phenotype that represents the solution itself. In each iteration, a new generation is created by applying crossover and mutation to candidates selected as the parents.

Evolution occurs by iterated stochastic variation of genotypes and selection of the fit phenotypes in an environment based on how well the individual solutions solve a problem. Here we use the binary coding scheme to represent a chromosome in the GA. In Figure 1 , loci through represent the encoding for the period of moving average. Loci through and through represent the encoding of and for the Bollinger Bands, respectively.

- Using Genetic Algorithms to Forecast Financial Markets!

- Comparison of Genetic Algorithms for Trading Strategies | SpringerLink.

- Using Genetic Algorithms to Forecast Financial Markets.

- swiss ecn forex brokers.

Finally, loci through represent the encoding of the weighting coefficient ,. In our encoding scheme, the chromosome representing the genotypes of parameters is to be transformed into the phenotype by 13 below for further fitness computation. The precision representing each parameter depends on the number of bits used to encode it in the chromosome, which is determined as follows: where is the corresponding phenotype for the particular parameter; and are the minimum and maximum values of the parameter; is the corresponding decimal value being truncated to integers if the parameter is of integer type , and is the length of the block used to encode the parameter in the chromosome.

With this scheme, we define the fitness function of a chromosome as the annualized return of the trading system over years of investment: where is the total cumulative return computed by Our overall GA-based arbitrage system is a multistage process, including the simultaneous optimization on the weighting coefficients for stocks, the period for the moving average, and the width of the Bollinger Bands.

The input to the system is the time series datasets of stock price. For any given combinations of model parameters of the moving average, Bollinger Bands, and the weighting coefficients of stocks, we employ the pairs-trading arbitrage system for investment. In this work, the timing for trading is designated as buying selling the spread right after it gets to a certain distance measured by standard deviations to the average below above the average and the position is then closed right after the spread gets closer to the mean.

We then compute the corresponding returns for the performance evaluation of the system. In this study, the GA is used as the optimization tool for simultaneous optimization of these model parameters. The final output is a set of models parameters optimized by the GA that prescribes the pairs-trading and timing models. The flowchart of this GA-based trading system is summarized in Figure 2. In this section we examine the performance of our proposed method for pair-trading systems. We use two sets of stocks listed in the Taiwan Stock Exchange for illustration: 1 the set of 10 stocks with similar characteristics from the semiconductor industry, which is the most important industrial sector in Taiwan over the past two decades, and 2 the set of the 10 stocks with largest market capitalization from various sectors, which denote distinct industrial characteristics in Taiwan.

The daily returns of the 10 semiconductor stocks in Taiwan from years to were used to examine the performance of the GA-optimized trading system. Table 1 shows the 10 stocks used for this subsection. Figure 3 displays an illustration of the best-so-far curve for the accumulated return i. In addition, in this study, the GA experiments employ a binary tournament selection [ 26 ], one-point crossover, and mutation rates of 0. This figure shows how the GA searches for the solutions over the course of evolution to gradually improve the performance of the trading system. Figure 4 displays an illustration of the accumulated return of the benchmark and that of our GA-based model.

This figure shows that the GA-based model gradually outperforms the benchmark and the performance discrepancy becomes quite significant at the end of year In addition, the GA also searches for the optimal timing for buying and shorting the stocks dynamically using the Bollinger Bands. In our study here, the weighting coefficients for the proportions of capital allocated to stocks, the period for the moving average, and the width of the Bollinger Bands are optimized simultaneously.

As a result, in our proposed methodology, a trading system optimized by the GA is a composite of optimal arbitrage and market timing models. Thus, one may expect the GA to be advantageous to the construction of the arbitrage systems and Figure 4 indeed shows that the GA-based model outperforms the benchmark in the long run. Therefore, these results shed some light on how the optimization by the GA may be advantageous to the pairs-trading model. In order to further examine the validity of our proposed method, statistical validation on the models is conducted in this study.

In reality, the learned model using the training data has to be tested by unseen data. Here, as shown in Figure 5 , we use the stock data of the first several quarters to train the model, and the remaining data is used for testing. However, in the financial study here, temporal order is critical since one would like to use all available data so far to train the model and to apply the models in the future for profits. In the training phase of each TV, we conduct 50 runs for the GA and the best model learned from each run is examined in the testing phase. In both of the training and testing phases, the cumulative total return accumulated return of a model over the quarters is calculated and the corresponding annualized return is computed by The annualized returns of the best 50 models in each TV are then averaged and displayed for the training and testing phases in Table 2.

In this table, we also provide the annualized benchmark return for further comparison with the GA-based models, where the cumulative total return for the benchmark is calculated from the product of the average quarterly returns of the 10 semiconductor stocks over the period of time in training or testing, and the corresponding annualized return is again computed by In Table 2 , an inspection on the means of annualized model returns shows that in all the 39 TVs of the training case the GA-based method outperforms the benchmark.

For the testing phase, in 30 out of 39 cases the GA-based method outperforms the benchmark. Figure 6 further displays a visual gist on this performance discrepancy of the two methods in the testing phase. As can be seen, in most of the TVs, the annualized return of the GA-based model is larger than that of the benchmark.

These results thus demonstrate our GA-based method is promising for solving the pairs-trading problem. Next we use the 10 stocks of the largest market capitalization listed in the Taiwan Stock Exchange to further examine our proposed method. The daily returns of stocks from years to were again used for the optimization task by the GA. Table 3 shows the 10 stocks with the largest market cap used in this study. Figure 7 displays an illustration of the accumulated return of the benchmark which is again defined as the product of the average daily returns of the 10 largest market cap stocks over the 10 years and that of our GA-based model.

As can be seen, the GA-based model gradually outperforms the benchmark over the course of investment during years to , and the performance discrepancy becomes significant at the end of year Develop and improve products. List of Partners vendors. In "A Random Walk Down Wall Street" , Burton Malkiel suggested, "A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.

Genetic algorithms are unique ways to solve complex problems by harnessing the power of nature. By applying these methods to predicting security prices, traders can optimize trading rules by identifying the best values to use for each parameter for a given security. Genetic algorithms GAs are problem-solving methods or heuristics that mimic the process of natural evolution. Unlike artificial neural networks ANNs , designed to function like neurons in the brain, these algorithms utilize the concepts of natural selection to determine the best solution for a problem.

As a result, GAs are commonly used as optimizers that adjust parameters to minimize or maximize some feedback measure, which can then be used independently or in the construction of an ANN. In the financial markets , genetic algorithms are most commonly used to find the best combination values of parameters in a trading rule, and they can be built into ANN models designed to pick stocks and identify trades.

Genetic algorithms are created mathematically using vectors, which are quantities that have direction and magnitude.

150,103 Quants.

Parameters for each trading rule are represented with a one-dimensional vector that can be thought of as a chromosome in genetic terms. Meanwhile, the values used in each parameter can be thought of as genes, which are then modified using natural selection. For example, a trading rule may involve the use of parameters like moving average convergence divergence MACD , an exponential moving average EMA and stochastics.

A genetic algorithm would then input values into these parameters with the goal of maximizing net profit. Over time, small changes are introduced, and those that make a desirable impact are retained for the next generation. See also: Basics of Algorithmic Trading. There are three types of genetic operations that can then be performed:.

- Elements of Genetic Programming.

- Evolving Trading Strategies With Genetic Programming - An Overview · Fabian Kostadinov.

- Computational Intelligence and Neuroscience?

- forex gra na sentymenty.

These three operations are then used in a five-step process:. Over time, this process will result in increasingly favorable chromosomes or parameters for use in a trading rule. The process is then terminated when stopping criteria are met, which can include running time, fitness, number of generations or other criteria. While genetic algorithms are primarily used by institutional quantitative traders , individual traders can harness the power of genetic algorithms—without a degree in advanced mathematics—using several software packages on the market.

These solutions range from standalone software packages geared toward the financial markets to Microsoft Excel add-ons that can facilitate more hands-on analysis.

An Intelligent Model for Pairs Trading Using Genetic Algorithms

When using these applications, traders can define a set of parameters that are then optimized using a genetic algorithm and a set of historical data. This is much more common. The loss function that evaluates the network simply does not encapsulate the goal of the loss function. Disclaimer: This code has been adapted from the code here to make it compatible to optimize neural networks that create trading strategies.