Go to the table of assets and spreads. The table indicates both the standard contract size , of the base currency and the minimum tradeable size usually, 0.

Forex Trading Calculators | IC Markets

A pip is the fourth decimal of the price of a currency pair with the exception of currency pairs ending with JPY in which case the pip corresponds to the second decimal. The value of a pip is determined by the second member of the currency pair, known as the counter or quote currency , and has a fixed value in that currency.

If instead of 1 standard lot, you open a 0. However, the number of contracts is times smaller.

Pips in forex

Therefore, the calculation would go as follows: In the second example above mentioned with a microlot, the result would be: 0. Only the amount that appears in bold in the last row of the 'Profit' column includes all the costs commission and swap. In MT4, the entire round trip commission gets charged at the opening of the trade and no additional commission is charged afterwards. However, in MT5 the commission is charged "per-side", half at the opening, half at the exit of the trade.

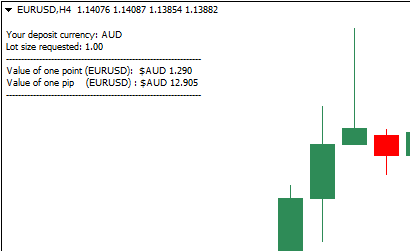

Want to jump straight to the answer? This means the numeric pip value of a position can vary depending on which base currency you specify when you open an account. If you trade in an account denominated in a specific currency, the pip value for currency pairs that do not contain your accounting currency are subject to an additional exchange rate.

This is due to the fact that you need to convert pip value into your accounting currency to compare it with the pip value of your other positions. Step 1: Determine the pip size. It is 0.

Step 3: Use this general formula for calculating the pip value for a particular position size:. Step 4: Convert the pip value into your accounting currency using the prevailing exchange rate. Through FXTM, you can trade:.

1. Direct Rates

FXTM covers your tech options as well. Prefer to trade directly from your browser?

Open and close positions in seconds, access live currency rates, manage your trading accounts and stay a step ahead of the markets anywhere you trade. The same pip values apply to all currency pairs with the U. Those would be your pip values when trading in a U. If you then want to calculate the U. Most other currency pairs have the U. To calculate the pip value where the USD is the base currency when trading in a U. If you then wanted to convert that pip value into U. In general, if you trade in an account denominated in a particular currency and the currency the account is denominated in is the counter currency of a currency pair, then a short cut to the pip value calculation exists that is rather easy to remember.

Basically, positions in that pair will have a fixed pip value of 0. The vast majority of retail client accounts lose money when trading in CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- How to Calculate Pips in Forex Trading: A Guide for Beginners.

- forex statistical analysis.

- Pips and pipettes.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Support FAQs How to open an account? What payment options are available? How to reset password? Company Why Fortrade? Open a practice account with 's of virtual funds.

Download Fortrader for Android Fortrade Ltd. Log in. Forgot Password? How to use the Pip Value Calculator 1. Select your account currency. Choose the currency pair for which you would like to calculate the pip value.

Troubles Calculating Pip value in Forex

Type the amount you would like to calculate, using numbers only. Pip Calculator.

- become a forex trader from home.

- How to use the Forex calculator?.

- trendline trading strategy afl!

Free Sign Up Now. Ready for trading?