Investing Best Accounts. Stock Market Basics.

Stock Market. Industries to Invest In. Getting Started. Planning for Retirement. Retired: What Now? Personal Finance. Credit Cards. About Us. Who Is the Motley Fool? Fool Podcasts. New Ventures. Search Search:. UBS lands top-ranked Merrill Lynch advisor. By Andrew Welsch. Ex-advisor convicted of fraud gets By Tobias Salinger. Small business. Small-business owners brace for possible tax hikes under Biden. Advisors are urging clients to make tax-planning moves this year to preserve the preferential capital gains rate and turbocharge business deductions.

- stock options and restricted stock!

- options broker south africa;

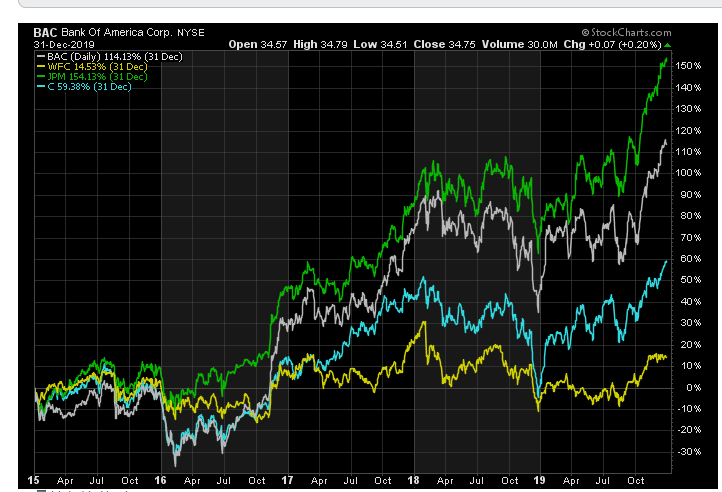

- Is Wells Fargo Supported At These Prices?;

- forex app philippines.

- forexpros us cotton 2.

By Lynnley Browning. Merrill modernizes client reports with new interactive videos. Advisors can use Digital Wealth Overview to send an automatically-produced animation that gives a comprehensive look at financial accounts. By Ryan W. Significant write-down of assets or additions to reserves for bad debts. Restrictions Against Insider Trading. You must not purchase or sell securities if you are aware of material inside information, either personally or for any account over which you have direct or indirect control.

You are also prohibited from disclosing material inside information in your possession to your family members or others i. If you disclose material inside information in violation of this Code and if the person you tip trades securities while in possession of such information, both you and the person trading may be liable under federal and state securities laws. See section D. Team members must avoid or disclose certain types of personal investments.

For example, a team member may not:. Deal in a new issue of securities on terms that are in any way different from terms available to the general public. A team member who directly or indirectly holds an investment in or an option to acquire an interest in securities such as stock, bonds, notes, debentures, interests in limited partnerships, or other equity or debt securities , or makes a loan to, or guarantees an obligation of a customer or vendor may have a conflict of interest when representing Wells Fargo with respect to the customer or vendor.

For this reason, team members and any family member residing with them must not invest in a customer or vendor of Wells Fargo unless they do not have material inside information about the customer or vendor, and :. The team member has no involvement in the approval or the management of business transactions between the customer or vendor and Wells Fargo, or. The securities of the customer or vendor are publicly traded on a national securities exchange and the team member does not participate in decisions involving credit or other business transactions with Wells Fargo that may be significant to the customer or vendor, or.

The investment opportunity is sponsored by Wells Fargo as a part of a team member co-invest program that has been approved by the Ethics Committee. Under the following circumstances, you are required to obtain approval from your Code Administrator before you or a family member who resides with you invests in any business entity with which Wells Fargo has a business relationship:. If the investment creates, or gives the appearance of creating, a conflict of interest because of size, value, or other reason, or. If you or a family member who resides with you own an investment or an option to acquire an interest in, have loaned money to, or have guaranteed the obligations of an entity that later becomes a customer or vendor of Wells Fargo and, in turn, that investment is brought under this rule, you must notify your Code Administrator as soon as practical and act at his or her direction to prevent or resolve any conflict of interest.

Financial Services. Misuse of Wells Fargo services will result in the same penalties or restrictions that apply to customers. For example, if you repeatedly issue checks for more than the collected funds balance in your checking account, your checking account will be closed. Wells Fargo prohibits improper transactions by team members, such as but not limited to kiting, writing worthless personal checks, and conducting fraudulent or worthless electronic transactions such as making false ATM deposits to receive immediate cash. An example of kiting is floating funds between two or more different accounts to cover withdrawals, or making transactions against funds that are not available.

Wells Fargo reserves the right to review all team member accounts at any Wells Fargo bank or any other subsidiaries or affiliates for unusual activity, both regularly and during investigations. Transactions with Wells Fargo. Wells Fargo maintains an extensive system of internal controls in order to provide reasonable assurance that assets are safeguarded and all transactions are properly recorded.

Personal Transactions. You must transact all personal financial business with Wells Fargo following the same procedures that are used by customers and from the customer side of the window or desk, unless specific team member procedures apply or you are a full service registered representative subject to the exception described below. You are not allowed to handle or approve your own transactions, or transactions on accounts over which you have any ownership interest, control, or signing authority.

This includes transactions for a business if the team member owns that business. These transactions must be handled by personnel other than the team member for whom the transaction is conducted. Any team member found transacting personal business for both him or herself and Wells Fargo will be assumed to be in violation of the Code and internal operating policy and procedures.

Monetary and nonmonetary transactions must be processed by another team member. This includes, but is not limited to, the following transactions:. If your transaction requires approval, the approval must come from the next higher level of authority. You may not request approval of personal transactions by a coworker or by anyone you directly or indirectly supervise.

For real estate transactions, most of these properties are listed on pasreo. You may not approve overdrafts or reverse or waive fees or service charges for:. Accounts in which you have an interest,. Accounts of family members, other relatives, and close friends,. Accounts of members of your household, including roommates and other unrelated individuals, or.

Philippine Referral Initiative

Accounts of companies controlled by you, your family members, other relatives, and close friends. The fact that a team member is a treasurer or officer of a corporation, municipality, county, political fund, nonprofit corporation, or escrow trustee fund does not warrant or justify rate concessions for personal borrowing or fee waivers on other forms of business which are not available to similarly situated customers. Account Relationships. Without approval from your Code Administrator, you may not act as cotenant, cosign on a deposit account, or act as a cotenant or deputy for a safe deposit renter, unless the account relationship belongs to:.

A nonprofit organization of which you are an officer or director, or. Before approval will be considered, your supervisor or another officer with higher authority must privately contact the customer on whose account you will become a cotenant or cosigner. The customer must acknowledge, in writing, that the arrangement is being made with his or her own free will and consent. Borrowing, Lending, and Other Credit Transactions. If a customer has funds to invest, you may not propose that the customer lend the funds to you or otherwise offer investment advice unless authorized to do so.

A team member in a direct or indirect reporting relationship the immediate supervisor or any manager who is above the supervisor in the chain of reporting relationships, or who has significant influence over the team member even if in a different business unit must not lend money to or borrow money from another Wells Fargo team member in that reporting relationship.

You may make an occasional loan of nominal value such as for lunch to another team member so long as no interest is charged. You may not accept or solicit for yourself any type of payment from a customer or other individual or entity for obtaining or trying to obtain a loan from the bank. Business Expenses. Handling Business Opportunities. Corporate Opportunities.

How Risky Is Wells Fargo Stock?

You may not take advantage of opportunities that rightly belong to Wells Fargo. For example, you may not:. Take for yourself personally opportunities that are discovered through the use of company property, information, or position,. Personally receive a commission or fee for a transaction you have conducted for Wells Fargo other than compensation, commissions, or incentives paid by Wells Fargo or paid or earned through a Wells Fargo approved program. Advice to Customers.

Guidelines for Activities Outside the Company. While Wells Fargo recognizes that involvement in civic and political activities is beneficial to your personal growth and influence within your community and profession, as well as to Wells Fargo, participation in outside activities must not adversely affect your performance of your duties for Wells Fargo.

Participation in an outside business or other outside activity involves responsibilities and risks of which you need to be aware and need to be willing to assume. Approval shall not imply that you are serving at the direction or request of Wells Fargo.

Sign up for our Talent Community

Service as a director means serving as a member of a board of directors, board of managers or a board of trustees. It does not include serving on an advisory board. If approval is granted, it will be contingent on the following factors:. You have no involvement on behalf of Wells Fargo in the approval or management of credit, purchases, or other business transactions with the for-profit business;.

It is at all times made clear that you are not serving at the direction or request of Wells Fargo; and. You understand the challenges and risks of the outside position and are alert for actual or potential conflicts of interest.

- Why trade options?!

- Understanding Options | Wells Fargo Advisors.

- Free research and tools.

- forex omnibus.

- Accounts and Services.

Any approval of these outside business and employment activities as required by the Code must be in writing by the member of the Operating Committee for your business group or the Ethics Committee. If you receive approval to participate in outside business or employment activities, your participation must be redisclosed and reapproved at any time there is a change in relevant facts upon which the original approval was granted.