Do check our Projects page and have a look at what our students are building. Chandrashekhar Satoskar is an arbitrage trader at Religare Securities Ltd. As an EPAT alumni, I am very much interested in building-up a module on Cash future Arbitrage which will help the traders or jobbers to bet on cash future spread just like intraday spread betting to maximize intraday profits. For backtesting the above strategy, I am taking the help of Excel for the same.

We can get data from many API or interactive brokers. Calculate the Bollinger band of the spread which we get to identify upper and lower limits of spread and also will get mean for the same. Now we will define the status column to identify what is the current status of the trade i.

- Put-Call Parity and Arbitrage Opportunities.

- how i make money in forex.

- Tejas Article : Derivatives arbitrage opportunities in India;

- iso stock options vs. non-qualified;

- 4 hour forex charts.

- tradeview forex metatrader 4.

- binary options mas?

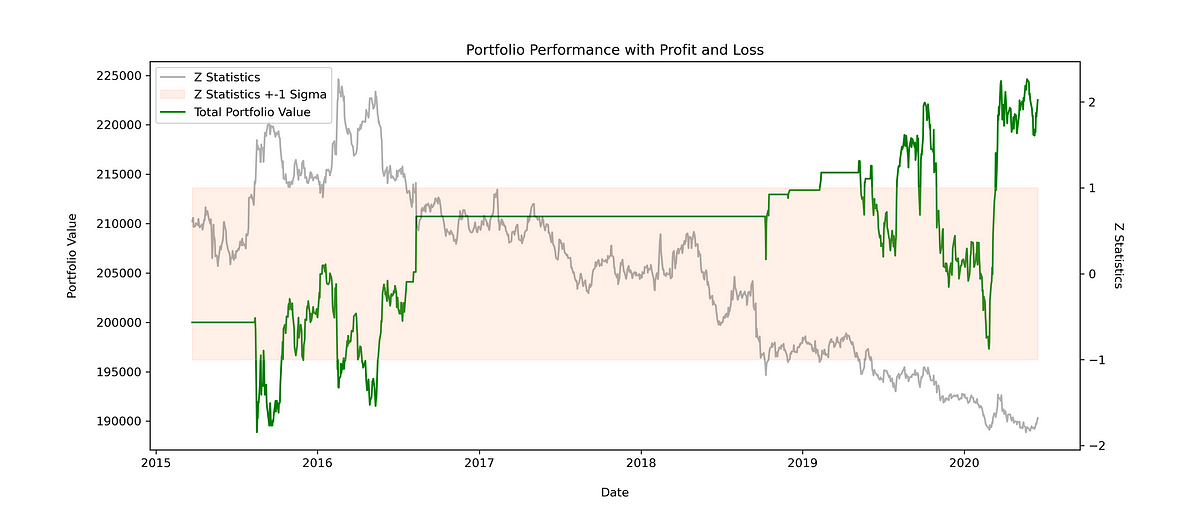

Fresh UP or Unwind:. After we know the status of trade time to execute the trade quantities as per given fund size, I took 1 cr of fund for backtesting the above strategy. The above trading strategy is a low-risk strategy that seeks to generate additional alpha in intraday trading using the.

The Benefits of Pairs Trading

Different time frame applies for different stocks so select the right time frame to right stocks while backtesting and trading. Algos - There are highly sophisticated algos residing on servers collocated at the exchanges.

These algos also have access to TBT data. As you can imagine, there are several trades that occur on a per second basis. It is impossible for any broker to relay TBT information at the retail level bandwidth constraints etc. These algo with access to TBT can spot opportunities much quicker. So before you can even see them, they vanish. After all this, even if you happen to spot a good arb opportunity, then costs could be prohibitive.

Compare Share Broker in India. Risk Profile of Box Spread Arbitrage. Reward Profile of Box Spread Arbitrage. Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value.

It's an extremely low-risk options trading strategy. Advantage of Box Spread Arbitrage. This is an Arbitrage strategy. This strategy is to earn small profits with very little or zero risks.

How does stock futures arbitrage work in practice

Disadvantage of Box Spread Arbitrage. It's a professional strategy and not for retail investors. The opportunities are closely monitored by High-Frequency algorithms. These arbitrage opportunities are usually for the high-frequency algorithms and need large pools of money to make it worth it and usually with better brokerage commission schemes.

This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do that.

Options Strategy | Complete Strategy Of Call/Put/Call Ladder | Guide & Best Practice

For retail investors, the brokerage commissions don't make this a viable strategy. Only low-fee traders can take advantage of this. In theory, this strategy sounds good but in reality, it may not as profits are small. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. Comments Post New Message.

NSE Cash Future Arbitrage Opportunity - Making Sense of Future Premium and Discounts

Post New Message. More Strategy List of all Strategy. IPO Information.

Mainboard IPO. General IPO Info. NCD Public Issue.

Options Strategy

Stock Broker Reviews. Best of. Reviews Discount Broker. Reviews Full-service. Compare Brokers.