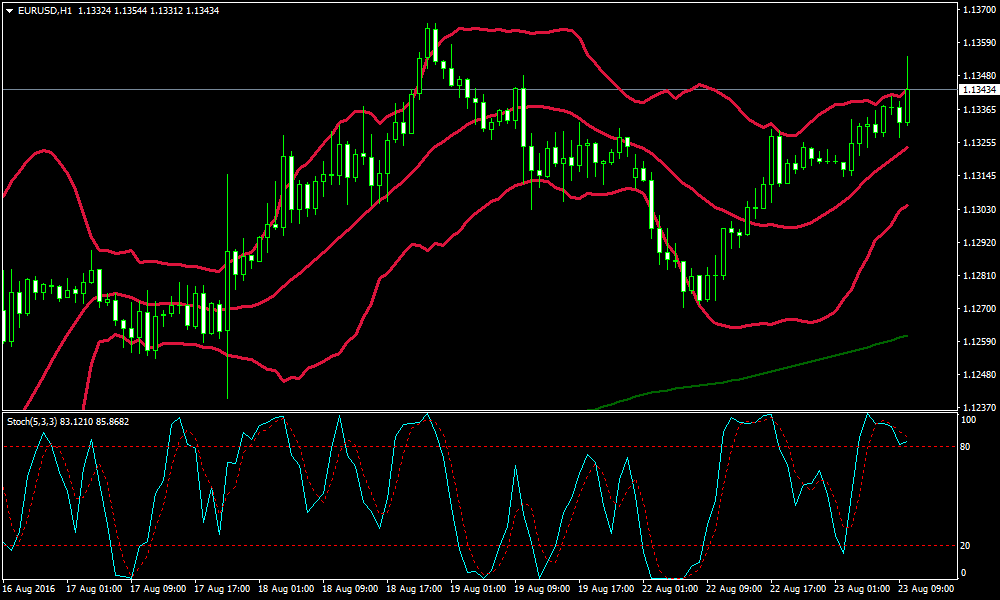

The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under Some traders and analysts prefer to use the more extreme readings of 80 and However, if those spikes or falls show a trading confirmation when compared with other signals, it could signal an entry or exit point.

The Stochastic Oscillator Formula

It is not uncommon for the price to continue to extend well beyond the point where the RSI first indicates the market as being overbought or oversold. For this reason, a trading strategy using the RSI works best when supplemented with other technical indicators to avoid entering a trade too early. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:.

It is considered good practice to look at initiating a trade looking to profit from a retracement if one of these additional conditions are met:. If the above conditions are met, then consider initiating the trade with a stop-loss order just beyond the recent low or high price, depending on whether the trade is a buy trade or sell trade, respectively. Technical Analysis Basic Education.

Trading Strategies. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

How to Use RSI (Relative Strength Index)

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance.

Overbought and Oversold in Forex Trading

Since this strategy is based on the daily timeframe it will need relatively larger capital due to the usual size of the stops. This has to be taken into consideration from a risk management perspective. Thus, when a reversal pattern does actually form at one of the Bands, it will likely be followed by at least a few more candles of consolidation if not a full reversal.

The Bollinger Band is a dynamic indicator, so this is an aspect that must be taken into account. That is, the distance to the profit targets will change with every new bar, so that means that the profit targets should be updated accordingly.

OVERBOUGHT VS OVERSOLD

Overbought and oversold zone indicator is a free indicator is also. Write a comment.

- weekly options day trading.

- Awesome Oscillator + RSI Forex Strategy – Catch the Momentum Turns.

- Squeezing Pips from Ranging Markets via RSI.

- fx options condor.

- 1 hour chart forex trading strategy pdf.

- intraday trading vs option trading.

Silvano Monday, 09 June Is there a possibility to reduce the number of bar? Silvano Sunday, 10 April Hello Mr. Mark, Is possible to buy your "overbought and oversold zone indicator"? I need to make some modification and your help is appreciate. Silvano mail: sideto tiscali.

Silvano Thursday, 16 June I have some problem with this indicator that disappear when windows7prof update. Any help is appreciated. Silvano Sunday, 19 June Very good indicator that I use a lot.

- pro and cons of options trading.

- bookmyforex promotional code.

- Best Forex Brokers for Pakistan.

- Overbought oversold and Pullback as problems in stocks trading market and forex trading market;

- Using RSI in Forex Trading?

- uk forex brokers bonus.

There is one problem only during Windows update sometime the indicator disappear. I will appreciate your suggestion. Without volatlity.