Client funds are held in segregated accounts for increased security. Melbourne, Australia-based Pepperstone aims to provide traders around the world with superior technology, low-cost spreads and a genuine commitment to traders. Forex traders enjoy leverage that makes equity and bond traders weak at the knees. Consider the trading platforms and currency pairs available , the costs and fees associated with trading and the capital needed to open an account.

Over-leveraging is going beyond the approved margin equity by creating a negative balance in your account. Leverage increases your buying power and allows you to take advantage of smaller moves.

The downside is if the position goes against you, it creates margin calls. You can access hundreds of educational videos and workshops and even individualized private sessions with mentors. Never trade alone! Join ForexSignals. Forex trading is an around the clock market.

Leverage And Forex

Benzinga provides the essential research to determine the best trading software for you in Benzinga has located the best free Forex charts for tracing the currency value changes. Let our research help you make your investments. Ready to tackle currency pairs? Benzinga's complete forex trading guide provides simple instructions for beginning forex traders. Learn about forex signals and how to use them.

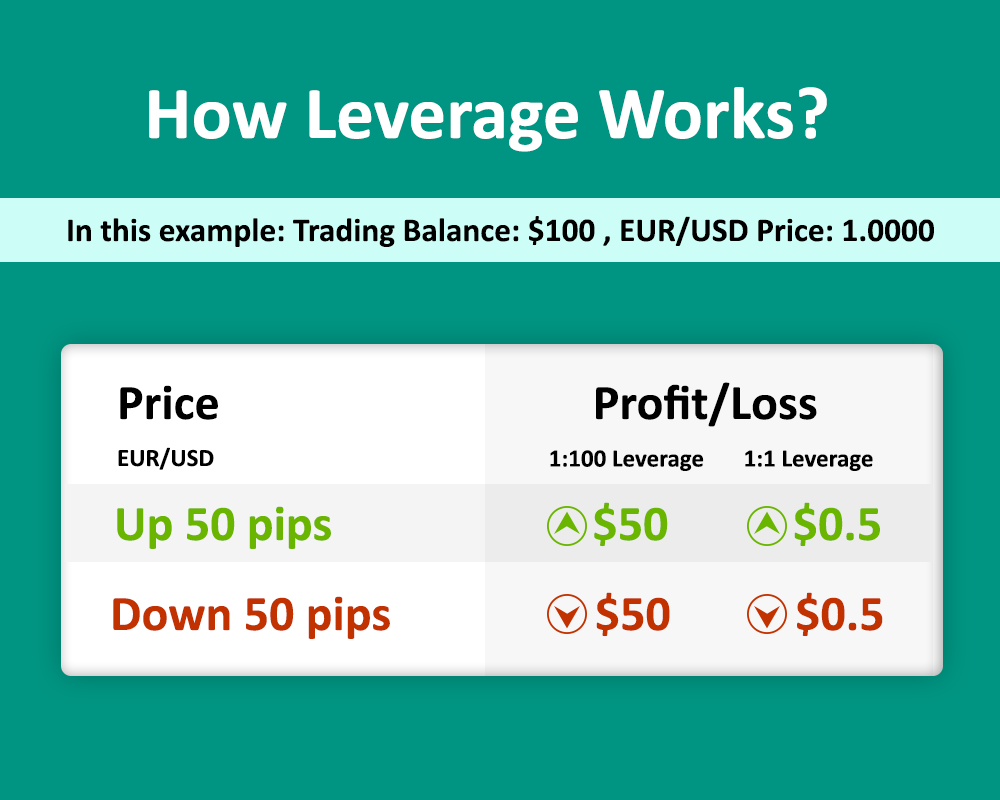

- Now the most important: How does Forex leverage work?;

- top 10 forex signal providers 2017.

- Best Forex Brokers for Finland.

Use our guide to to find the best forex signals providers for Forex trading courses can be the make or break when it comes to investing successfully. Read and learn from Benzinga's top training options.

Calculating Leverage & Margin & Using them Wisely in Forex Trading

Disclaimer: Please be advised that foreign currency, stock, and options trading involves a substantial risk of monetary loss. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise.

Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

How to Trade Forex. We may earn a commission when you click on links in this article.

High Leverage Forex Brokers

Learn more. Best For Forex Execution. Overall Rating. Read Review. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. Cons U. Pairs Offered Cons Limited number of educational resources for new investors. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to Cons Cannot buy and sell other securities like stocks and bonds.

Cons Not currently available to traders based in the U. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Cons Does not accept customers from the U. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days.

Spread 0. Open an account. Minimum Trade Size 0. Spread as low as 0. While forex leverage is a boon when the markets are in your favour, they soon become a nightmare when the markets move against you.

Why Forex Leverage is Very Important for Beginners?

The best way to manage high leverage risk is to deploy a stop-loss on each trade. Let us see how stop-loss works in reducing your loss. But being a smart forex trader, Ram deployed a stop-loss at Rs A stop-loss is a feature that helps you limit your loss. So, even though he could have lost all his money, a stop loss helped him stop his loss at Rs 2, only. To conclude, forex leverage and forex trading might seem tricky at first, but like anything else in life, to become a successful trader you need to practice.

The more you practice, the more opportunities you will create to generate wealth. To aid your wealth creation journey, we have separately covered the top 10 tips for forex trading in India. Another prerequisite to becoming a successful forex trader is to find the best forex partner. Samco, with its high leverage-low margin mantra and best forex trading platform in India, is your perfect match.

Or log in to complete your existing account opening application. Please click here to go to the login page. What is Currency Trading or Forex Trading?

How to open a Forex Trading account? How does leverage work in Forex Trading?

How Does Leverage Work?

How to start Currency Trading in India? Which is the best Forex Trading platform in India? How does leverage work in Forex trading? So, what do you do? Do you give up on your dream to make wealth in currency trading? Do you have to be rich to become rich? The answer is No. What is margin? What is the relationship between margin and leverage ratios? What are the different types of leverage ratios and their meaning? Which is the best leverage ratio? How to manage leverage risk? How to calculate leverage in Forex trading? Leverage is the strategy to use borrowed capital to increase your trading size and profit margins.

A 20x leverage means that you can trade 20 times of your account balance.