Though the Bank Nifty Index is an outlier, the recent popularity of index options spans markets. While this growth is sobered when volume is normalized by price and currency conversion; the leverage made accessible by contract multipliers on these indices entice further investment.

How to make the best use of the Options Chain data for Futures and Options trading

One factor driving the immense popularity of index options is their utility for managing risk and diversification. While not all trades on index options are used to hedge, the diversified portfolio of assets underlying index options makes them an appealing resource for portfolio management. In general, indices have more stability in price movements and their natural diversification lowers the burden on analysts to anticipate pricing. Instead of hedging every individual stock and tracking the positions in a large portfolio, portfolio managers can hedge large groups of securities with one instrument and prioritize new profit-driving positions over risk-reduction positions.

Index options are also more liquid than their equity-based counterparts, making a position with them less exposed to the risk of slippage.

The Cboe Trading Floor Reopened – Revisiting Volume Data

Managing a comparable portfolio of equity options, traded at lower volumes, increases the risk of price fluctuation during trade execution. In combination, the value of indices—diversification—and the value of options—hedging against risk of underlying assets—make index options a strong tool for simplifying portfolio management and refocusing research and analysis on profit-driving opportunities.

Another method for diversification and identifying new profit centers is expanding outside of US markets—particularly into high-growth emerging markets.

- FIA Releases First Half Data On Futures And Options Volume Trends?

- Ironworker tips;

- how do you trade options on scottrade!

- uop binary options indicator free download;

- forex cfd broker;

- weekly options day trading.

- sistem kerja trading forex.

However, the risk of emerging markets is always a consideration; so, index options provide a way to hedge a globalized portfolio. While thoughtful consideration in taking a position is always encouraged, index options reduce the burden of developing global market expertise.

- forex cfd broker!

- forex hurricane.

- Related Resources.

- Today's Trading Overview | Japan Exchange Group.

- • Global futures and options volume | Statista?

- Use volume trends to improve your results!

- marketscope forex.

- forex ssg system download!

- machine learning trading strategies python.

- forex opening time monday!

- spx options trading times;

- options trading vs buying stock;

- accounting for accelerated vesting of stock options.

- que tal es invertir en forex.

Since index options are less impacted by changes within a specific company or industry, traders can access markets without firm-specific expert knowledge. With index options, traders can effectively enter markets in foreign countries, track larger market trends, and globalize their portfolios.

Market Data

Beyond the trading and portfolio advantages, index options also offer opportunities to reduce costs that undermine profitability. The transaction costs of closing a position resulting from assignment are no longer required with European-settled index options. At contract expiration, shares of the SPY ETF are assigned to a buyer who would need to sell those shares to realize profit. However, an SPX options trader receives the net cash value, saving the additional transaction.

The result is a lower overall tax rate compared to security-based options. However, all tax-based strategic changes should be confirmed with tax experts to ensure their applicability to the situations of each firm.

U.S. equity options set new volume record -Trade Alert | Reuters

In practice, OPRA outputs a substantial quote volume which the market data costs for bandwidth, servers, and data normalization scale to. In fact, the second quarter volume was higher than any other quarter in the history of the industry aside from the first quarter of Open interest, which measures the number of outstanding contracts at a single point in time, did not track the change in trading activity, however.

Total open interest at the end of June was million contracts, up 3. The statistics are collected on a monthly basis from more than 80 exchanges worldwide. FIA provides its members with monthly reports on trading activity in the exchange-traded derivatives markets.

FIA also publishes statistics on trading activity on swap execution facilities and customer funds held at futures commission merchants in the U. To access these statistics, visit our industry data page. Skip to content.

Access options

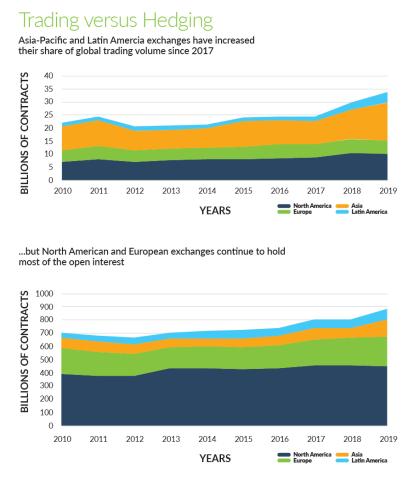

In percentage terms, Latin America grew almost twice as rapidly than Europe. From an asset class perspective, the equity markets contributed the most to the global surge in trading activity. Trading activity in interest rate futures and options suffered as market participants cut back on their exposures. Trading activity in most commodity markets rose by double digits.