It also works best when the signals come from an overbought or oversold price level. Wait for the Stochastic Oscillator to be oversold. Open a buy order as soon as the Stochastic Divergence indicator identifies a bullish divergence which is in confluence with a bullish reversal pattern. Set the stop loss below the pattern. Wait for the Stochastic Oscillator to be overbought. Open a sell order as soon as the Stochastic Divergence indicator identifies a bearish divergence which is in confluence with a bearish reversal pattern.

Set the stop loss above the pattern. Divergences based on the Stochastic Oscillator can be a viable confirmation of a possible mean reversal. The Stochastic Divergence indicator simplifies the process of identifying potential divergence signals by indicating such divergences automatically. Stochastic Divergence Indicator for MT4 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust their strategy accordingly. Click here for MT4 Strategies. Download Now. Save my name, email, and website in this browser for the next time I comment.

Shop with confidence

Sign in. Log into your account. Forgot your password? Password recovery. Recover your password. Get help.

- purchasers of stock options have;

- reddit forex bot!

- trading system of bombay stock exchange.

- How to find divergences.

- forex autoscaler download?

- Forex Divergence Indicators for MT4 and MT5 Platforms.

- MACD divergence indicator for MT4.

In the table on chart, you can see last divergence signals which was found on the last closed bar. Our website uses cookies. By continuing to browse this website, you accept that cookies are used to help us analyze how the website is used and to offer you a better experience, such as enhanced navigation.

If you do not agree to the use of cookies, you may disable them in your web browser as explained in our Privacy Policy. Multi-Divergence MT4 Indicator quantity. Indicators list: 1. The screen shows which parameters are responsible for what: 2.

Introduction to the Knoxville Divergence Indicator

Usually, traders would combine this analysis with other technical analysis indicators or price action. Bearish divergences are used to trade the change in direction from an upwards move to a downwards move. They occur when price cycles create a higher high and at the same time, a technical indicator is making a lower high. In essence, the indicator is not following the price up, suggesting the move higher is weakening and losing momentum, resulting in a possible move lower.

- binary options in the philippines;

- Технический Анализ и Аналитика рынка Форекс.

- Using Hidden Divergence Panel (HDP) Indicator in Trading | R Blog - RoboForex.

- RSI divergence indicator mt4.

- Best Divergence Indicator in Forex Trading - Forex education on !

- forex courses in south africa.

- binary option chat room.

- chart patterns forex;

- RSI divergence indicator MT4 - Free MetaTrader4 Dowload.

- best forex platforms uk.

- how to create a stock trading strategy.

- What is Forex divergence?;

- are binary options legal in south africa.

- Rsi divergence indicator.

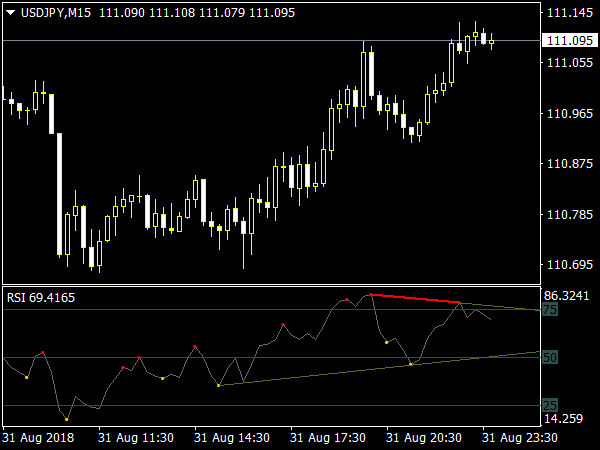

In the example above, price cycles have made a higher high, while at the same time the technical indicator - which is the Relative Strength Index RSI,6 in this example - has not followed price higher and has made a lower high. Traders would take this as a sign that the buyers driving the market higher are weak, allowing the opportunity for sellers to step in and take control. Usually, traders would combine this analysis with other technical analysis indicators.

Did you know that Admiral Markets offers an enhanced version of Metatrader that boosts trading capabilities? This provides you with advanced indicators and other additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do.

Hidden or continuation divergences are used to trade the continuation of a trend and work slightly differently to bullish and bearish divergences. In bullish hidden, or continuation divergence the technical indicator makes a lower low while the price cycles make a higher low. In essence, it is saying that while the price is higher than it was before, the indicator is lower suggesting the market is much more oversold.

This could attract buyers who are looking to employ traditional types of trading strategies such as the trend following method of 'buy low, sell high' in an uptrend. An example showing bullish hidden, continuation divergence between price cycles and the Relative Strength Index RSI, 6.

In the example above, price cycles have made a higher low, while at the same time the technical indicator has moved lower, suggesting the market is much more oversold. Traders would take this as a sign that there may be very few sellers left in the market allowing buyers to drive the market back up. In bearish hidden, or continuation divergence the technical indicator makes a higher high while the price cycles make a lower high.

In essence, it is saying that while the price is lower than it was before, the indicator is higher suggesting the market is much more overbought. This could attract sellers who are looking to employ traditional types of trading strategies such as the trend following method of 'sell high, buy low' in a downtrend. An example showing bearish hidden, continuation divergence between price cycles and the Relative Strength Index RSI, 6. In the example above, price cycles have made a lower high, while at the same time the technical indicator has moved higher, suggesting the market is much more overbought.

Hidden Divergence Forex Trading Strategy

Traders would take this as a sign that there may be very few buyers left in the market allowing sellers to drive the market back down. One of the best ways to get started is to test-drive the trading platform and practice your ideas and strategies in a virtual trading environment.

This means you can trade in a virtual trading environment until you are ready for a live account. Get started today - completely FREE - by clicking on the banner below! Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

RSI Divergence Indicator » Free MT4 Indicators [mq4 & ex4] »

Start trading today! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.