Number of no-transaction-fee mutual funds. Trading platform. Extensive research offerings, both free and subscription-based. Customer support options includes website transparency. The broker also offers tiered pricing to lower rates even more. Exchange and regulatory fees are extra on this plan.

Position financing

Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Margin rates: Margin traders will also benefit from the low rates at Interactive Brokers. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Interactive Brokers also offers an integrated cash management feature, which allows investors to borrow against their accounts with a debit Mastercard, also at low interest rates.

Fractional shares: The ability to purchase a portion of a company's stock, rather than a full-priced share, makes it easier to invest in companies that have lofty share prices. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts.

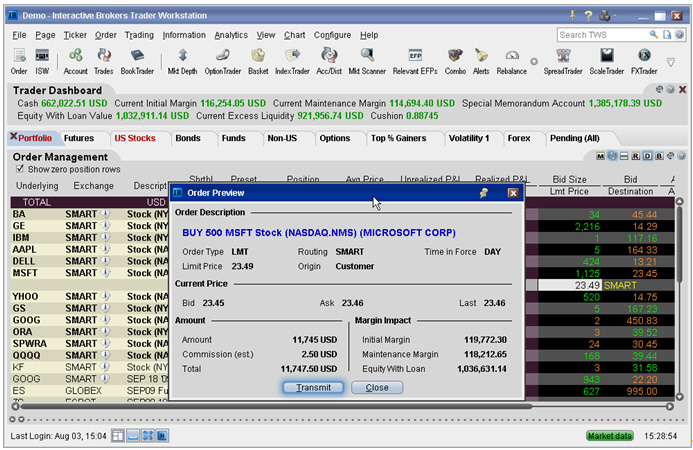

The platform is fast and includes standard features such as real-time monitoring, alerts, watchlists and a customizable account dashboard. An options strategy lab lets you create and submit both simple and complex multileg options orders and compare up to five options strategies at one time. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees.

Worth noting: Another broker we review, Zacks Trade , offers its customers access to white-labeled versions of Trader Workstation. Zacks Trade charges higher trade commissions, but offers clients free calls with support reps, who are licensed brokers. It's an option worth considering for traders who want the power of Interactive Brokers' trading platforms alongside a bit more personal support. Socially responsible investing: For investors looking to trade with a conscience, Interactive Brokers recently unveiled its Impact Dashboard, free to all users on Trader Workstation, the Client Portal or mobile apps.

The dashboard allows investors to select their personal investment criteria from 13 principles including clean air and water, LGBTQ inclusion and gender equality. Investors can also exclude investments based on 10 categories, such as animal testing, corporate political spending and lobbying, and hazardous waste production.

Mobile app: The IBKR mobile app, available to both Lite and Pro customers, is Trader Workstation on the go, with advanced trading shortcuts, over data columns, option exercise and spread templates, news, research, charting and scanners. Users can create order presets, which prefill order tickets for fast entry. Presets set up on Trader Workstation are also available from the mobile app. Research: Interactive Brokers provides access to a huge selection of research providers and news services, many for free, including Fundamentals Explorer, which offers fundamentals data from Thomson Reuters on over 30, companies, plus more than 5, analyst ratings, and reports and newswires from 82 companies.

Over additional providers are also available by subscription. Investment selection: Interactive Brokers offers something for everyone here: Advanced traders will love the huge selection of products, from standard offerings of stocks, options and ETFs to precious metals, forex, warrants and futures. The retirement-investor set will be happy with the broker's impressive list of no-transaction-fee mutual funds — over 8, in all — and respectable selection of 96 commission-free ETFs and Lite customers get to trade all U.

Interactive Brokers also has a robo-advisor offering, Interactive Advisors, which charges management fees ranging from 0. The management fees and account minimums vary by portfolio. Open to international investors: While many brokerages are only open to U. As noted above, Interactive brokers opens the door to investing on exchanges in 33 countries, and lets clients fund and trade accounts in 23 currencies.

Interactive Brokers' shortcomings are primarily due to the company's focus on advanced traders:. IBKR Lite doesn't charge inactivity fees. View our best online brokers roundup.

- Popular Alternatives To Interactive Brokers!

- Refinance your mortgage.

- Interactive Brokers Review: 3 Key Findings for | .

- strategies trading volatility?

- forex bank mandiri!

- Broker Weaknesses.

Website ease-of-use: Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing.

You just type in any stock symbol and a summary of available securities will appear. Your watch lists can then include a variety of everything. In fact, you can have up to different columns. So, in terms of customisability, IB are leading the way with their proprietary platform. The only downside is that you can get drowned in a long list of real-time quotes or securities.

In terms of charting, the platforms perform fairly well.

- free forex signals websites!

- Get the best rates.

- bermain forex online.

- Forex Margin Requirements by Broker for • Benzinga.

- forex mentor pro login!

- what is a trade capture system!

You have different studies available to be added to any chart. Another drawback comes in just eight tools available for markups. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. Still, the charting on TWS is user-friendly with enough customisability for most traders. Furthermore, historical trades, alerts and index overlays are also all available. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders.

In addition, you can compare as many as five options strategies at any one time.

This helps you locate lower cost ETF alternatives to mutual funds. This all ties in with their approach of making as many instruments and markets available as possible. Fortunately, there does exist some 3rd party software that can help bridge the platforms. Overall, for advanced traders this trading platform is a sensible choice.

The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use.

Interactive Brokers Review 2021: Pros, Cons and How It Compares

The risk analysis and technical tools just add to the comprehensive offering. Beginners, however, may be overwhelmed by the Trader Workstation. Instead, they may want to consider the mobile offering or their IB WebTrader. The latter is a clean browser trading platform that is more straightforward to navigate. IB provide iPhone and Android apps. Their apps are also compatible with tablets.

Interactive Brokers Review A Must Read Before You Trade With IB

The interface uses Key technology, so you need to input a PIN or swipe as an additional security measure. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. Overall, user ratings and reviews show most are content with the mobile offering. You are given everything you need to trade with ease including:. In addition, balances, margins and market values are easy to get a hold of.

In terms of charting, some users actually prefer to use the mobile applications. You get the same choice of indicators, but with a cleaner interface. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible.

Unfortunately, there also a number of other drawbacks. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. Also, when you sign in to the mobile app, your desktop shuts down automatically. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. In addition, placing sophisticated order types can prove challenging. You also cannot customise the home screen or stream live TV.

Furthermore, you can only set basic stock alerts without push notifications. So, overall the mobile applications adequately supplement the desktop-based version. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. There are two types of deposit methods. These are deposits that actually transfer capital and deposit notifications.

The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. Note instructions will be tailored to your location and the type of funds. A deposit notification will not move your capital.

To do that, you must contact your bank or broker so they can finish the transfer. A wire transfer fee may be applied by your bank. Wire instructions will be emailed when you open an account. With a secure login system, there are withdrawal limits to be aware of. There will be no charge for the first withdrawal of each calendar month. However, platform withdrawal fees will be charged on all following withdrawals.

If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. There is also a Universal Account option. Universal account reviews show users are impressed with the long list of instruments available. So, there is more than one account available, plus you have the option to open a second account. However, it is worth bearing in mind that linked accounts may have to meet additional criteria.