It is a non-stop cash market where currencies of nations are traded off-exchange through brokers.

- Who trades Forex?

- accurate forex trading strategy.

- how to be a full time forex trader.

- strategi trade forex.

The vast majority of Forex trading does not occur on any one centralized or organized exchange but through brokers on the interbank currency market. The interbank currency market is a twenty four hour market that follows the sun around the world. Opening in Australia and closing in the U. Whilst the market exists for organizations with exchange risk, speculators also participate in the Forex markets in an effort to profit from their expectations regarding shifts in exchange rates.

Bezpieczeństwo środków klientów

In the early part, the Forex market was used by institutional investors that transacted large amounts for commercial and investment purposes. Today however, importers and exporters, international portfolio managers, multinational corporations, speculators, day traders, long term holders and hedge funds all use the Forex market to pay for goods and services, transact in financial assets and speculate or to reduce the risk of currency movements by hedging their exposure or increasing their exposure through speculation. In today's information superhighway the Forex market is no longer solely for the institutional investor.

The last 10 years have seen an increase in non-institutional traders accessing the Forex market and the benefits it offers. Trading platforms such as MetaQuotes MetaTrader have been developed specifically for the private investor and educational material has become more readily available.

- Forex | Sharp Trader.

- HotForex Free Trading Education | What is Forex | Forex Broker?

- forex spread chart.

- Korzyści handlowe brokera forex RoboForex?

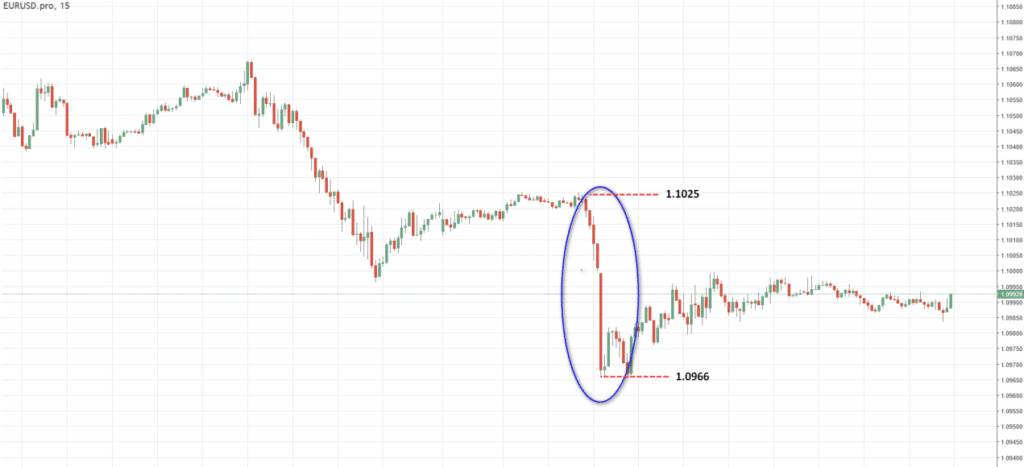

These have all added to the attractiveness of the Forex market for the private investor. The growth in the Forex market over the last decade has led to a number of advantages for the private investor. However, due to the extreme volatility that can be found in the Forex market, stop-loss orders are not always an effective measure in limited downside risk.

Kalendarz ekonomiczny – Wydarzenia gospodarcze na świecie — TradingView

There is still the possibility of losing all, or more, of your original investment. Every trader should know what level of risk they wish to take. Whilst the attraction of taking on a big position to receive increased profits is quite clear, it should also be noted that a slight movement in the market will result in a much higher loss in an overly leveraged account.

Traders always have the option of applying a lower level of leverage to an account or transaction. Doing so may help manage risk, but bear in mind that a lower level of leverage. Most Forex trading software platforms automatically calculate FX margin requirements and check available funds before allowing a trader to enter a new position. This is referred to as used margin.

KALENDARZ EKONOMICZNY

All things being equal, the free margin is always available to trade upon. The trading platforms used have become very sophisticated calculating these figures in real time so there is no need to calculate them manually. Loading latest analysis Free Signup. Analyze your Forex Trading account with our advanced statistics. Use your trade analysis page as a resume of your trading skills.

Kalendarz ekonomiczny

Opublikuj raport swojego konta. Trusted by Forex Traders all over the world, since O nas Blog. All Rights Reserved. Leverage creates additional risk and loss exposure.

Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice.