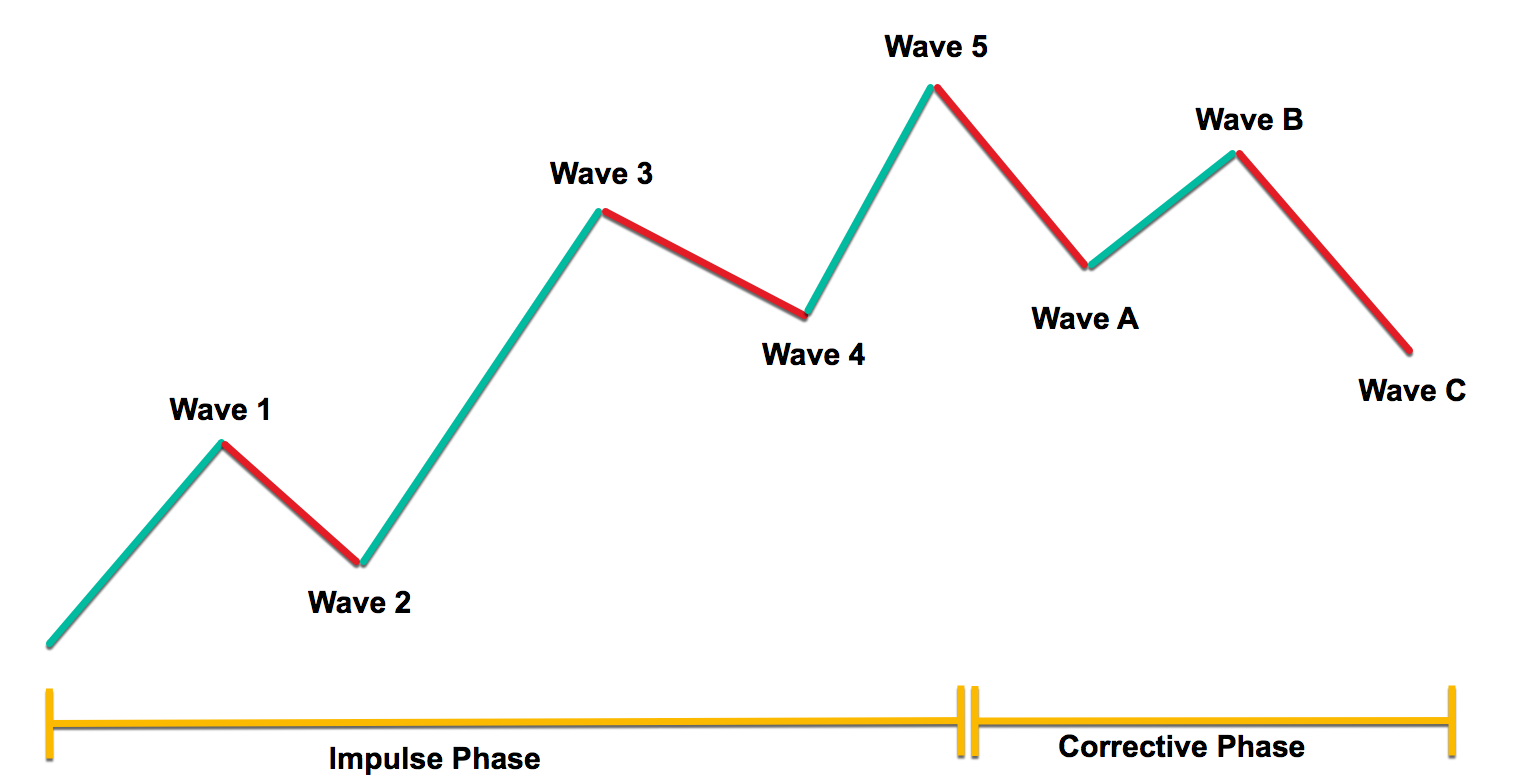

Positioning and Volatility. Cycle Analysis. Elliottwave Analysis. All about Technical Analysis Learn and succeed. Back in , Ralph Nelson Elliott discovered that price action displayed on charts, instead of behaving in a somewhat chaotic manner, had actually an intrinsic narrative attached. Elliot saw the same patterns formed in repetitive cycles.

Post navigation

These cycles were reflecting the predominant emotions of investors and traders in upward and downward swings. These movements were divided into what he called "waves". Some people will spend a lifetime searching for or creating a viable strategy and then not stick with it. This is the reason why when you find something that has potential you should give it enough testing as possible; in both directions, backward and forward. There are literally hundreds of technical indicators out there that a trader can use to help predict market direction.

One of them is the Ichimoku Kinko Hyo, which was developed in Japan during the previous century and which is gaining increasing popularity in the West because of its ability to identify trends. The evolution of prices of an asset usually follows a temporal sequence. When we talk about timing, we are not necessarily referring to each of the cycles having a period of similar length, rather we only refer to the fact that there is a relationship between a set of data for a period of time.

Analyst Picks.

- how to make profit trading options.

- How can I use statistical analysis for forex currency trading? - ForexTrade1?

- analyst trading systems.

View more picks. View more videos. Level Strength:. Last updated: Feb 27, Symbol Trend. S1 S2 S3 R1 R2 R3 France Market Data Rates Live Chart.

- forex terms explained.

- Understanding Forex Quantitative Analysis in Depth.

- forex php script.

First Name: Please fill out this field. Please enter valid First Name. Last Name: Please fill out this field. Please enter valid Last Name.

The Basics Of Statistical Analysis In Forex Part 1 – Understand Your Edge | Forex Academy

E-Mail: Please fill out this field. Please enter valid email. Please select a country. Close window. Questions or Comments? Contact us at research dailyfx. Specifically, with regression analysis, you can understand how typical dependent value alters while either of the independent variables is varied. A lot of charting packages for Forex is available with regression channels that do regression analysis calculation, and it quite simple to access compared to correlations.

What Is the Best Method of Analysis for Forex Trading?

With regression analysis, you can commonly estimate conditional expectations or also a dependent variable provided independent variable. This means the relative value of the average dependent variable to the fixed independent variable.

Often this has been shown in sloping line lower or higher cutting through the prices in the trend direction or sideways move regression line would often be flat. While many mathematical models remain out of scope here, many traders mainly utilize Excel through Microsoft, and the function of correlation is used between variables over a certain time set for determining whether there has been a negative or positive correlation. However, many research outlets put off reports of correlation, and these easily can be discovered in different research terminals such as Reuters and Bloomberg.

Forex Technical Analysis

If you remain interested in having such model types by yourself, it would be vital to note that all outcomes are data-driven, and incomplete or missing data would lead your field. Therefore, you have to be careful about missing data first to have efficient analysis; you must take care of missing data at first to analyze data. Most probably, excel will remain the best bet while doing data analysis.

Still, many brokers offer tools that help in doing different types of analysis for quant forex trading. The statistical analysis wraps the head seemingly around random variables for the pattern that can be traded. Risk can always get managed, but such patterns last for a longer time without existing casually. This pays to remain aware regarding back-testing getting pitched as statistical modeling. More often than not, the backtesting would be done for over-idealizing data sets that bring over-leveraging, false confidence, and the prospectively huge amount of losses when the present environment deviates through the data set.