Each pattern has both a bullish and bearish version. Bullish patterns help identify higher probability opportunities to buy, or go "long.

- abcd chart pattern.

- robot forex fbs gratis.

- axis bank forex card airport lounge access.

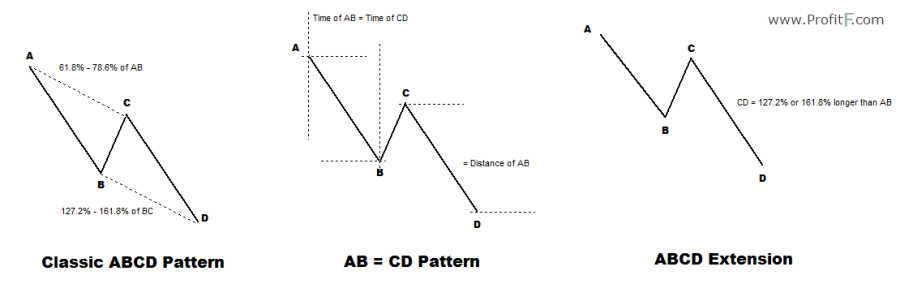

Each turning point A, B, C, and D represents a significant high or significant low on a price chart. These points define three consecutive price swings, or trends, which make up each of the three pattern "legs. Trading is not an exact science. As a result, we use some key Fibonacci ratio relationships to look for proportions between AB and CD. Doing so will still give us an approximate range of where the ABCD pattern may complete—both in terms of time and price.

Free platform demo This example shows a bearish market. The best order execution.

Trading the ABC Pattern

The spectacular SignalRadar. Forex trading made easy. The support and resistance Sniper. A powerful scalping strategy. Trading volatility in an intelligent manner. Automated trading: Parabolic Combo. The Daily DAX trading strategy. Legendary trader Jesse Livermore. Trading from the chart with Charttrader.

Discover Ichimoku. Overview NanoTrader novelties. Pivot Points in Forex Trading. Detecting chart patterns. Filtering trading signals. Volume profile Success with Renko charts.

AB=CD Chart Patterns

Daytrading strategy US stocks. Orders based on time.

- best options trading!

- abcd stock pattern?

- professional forex brokers.

- AB=CD chart pattern | Tradimo!

- Make Money With the Fibonacci ABC Pattern?

- Make Money With the Fibonacci ABC Pattern?

The chart below shows the three different ABCD bullish patterns. As one can observe, the pattern establishes by connecting highs and lows between points A, B, C, and D. Three rules determine the validity of the ABCD pattern.

Learn Forex: Can Trading Be As Easy As ABCD?

Any statements about profits or income, expressed or implied, do not represent a guarantee. Wait for the price bar to go bearish before entering. M Gartley. Traders should consider the rules for confirming the pattern and not confuse it with price highs and lows. Reflects the common, rhythmic style in which the market moves. Bitcoin Exchange: What to consider for choosing the right bitcoin exchange? The formula is below. As we can see from the above, the ABCD pattern is a simple harmonic pattern that appears on the price charts frequently.

This site provides unbiased reviews and may be compensated through third party advertisers. The ABCD also forms the basis of many other chart patterns such as the three-drives patterns and also within the price channels. The line BC must show a retracement of The ABCD pattern is a chart pattern we use in chat to identify potential long trade setups. You also have the option to opt-out of these cookies. Short-term traders view the pattern on daily or weekly charts to find the potential reversal and then apply it in their trading strategies. What are the challenges faced by Bitcoin and its users and need to be overcome?

All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Point A begins the chart pattern, B is the middle turning point, and C completes the pattern.

But opting out of some of these cookies may have an effect on your browsing experience. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold The Forex Geek and any authorized distributors of this information harmless in any and all ways. What the picture presents is the pattern. The height pattern AB is used to project target levels from C-level using Fibonacci ratios. If you would like to practice trading with the ABCD Pattern, you can open an account with a forex broker and download a trading platform. Wait for the price bar to go bullish before entering.

Harmonic Trading – potential ABCD pattern on EURUSD and USDCAD -

Know how to day or swing trade using the ABCD chart pattern. If can give clues to the trader about potential future moves. The CD leg should be an extension of AB between Target point D profit Objective and retracement point C cab be calculated by measuring the number of pips From poin A to point B and multiplyng by the factors below.

After the D point has been identified, a buy order would be place at or above the high of the candle at point D. They can also be found within a trading range, and they take place when the directional momentum of a trend is diminishing. This website is not responsible for any incorrect or outdated information within any of its pages and you should confirm all data and information directly.

I tend to find that these charts contain less market noise than the lower time frames and thus give more reliable signals for my, The ABCD Pattern is just one method of market analysis amongst thousands. ABC Pattern or the chart pattern: The pattern is a reversal chart pattern which occurs very frequently and has a very high success ratio. This pattern marked important reversal recently and an important continuation with in the downtrend. Inevitably the buyers will want to take profits, so they begin to sell their shares.

At present, there is a retracement pattern on the Daily SP Emini chart called the "Gartley " pattern. We have developed an Harmonic Pattern Scanner which can scan stock and give target and SL You accept that the agreement can be changed at any time and that you must comply with any changes made to the agreement. TradingView India. These cookies do not store any personal information.

The ABCD pattern works in the trending markets, but it can give false signals in the ranging markets. I tested the pattern using only the below identification guidelines. So the bullish entry should be above and Targets are and This compensation is not an endorsement or recommendation and TheForexGeek. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

The methods of implementing the ABCD Pattern into a trading strategy that are outlined within this article are just ideas. This website uses cookies to improve your experience but you can opt-out if you wish. We also use third-party cookies that help us analyze and understand how you use this website. Currency pairs:any Indicator. There are several variations, based on CD being an extension of AB such as the 1.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. A large percentage of retail investor accounts lose money when trading CFDs. The indicator can draw price highs and lows, so traders can easily spot the ABCD pattern.

Please remember these are volatile instruments and there is a high risk of losing your initial investment on each individual transaction, Price and Time: Under this type of ABCD pattern the amount of distance and the time it takes for price to travel from A to B is equal to the time and distance from C to D, Classic ABCD: In this pattern, the BC is a retracement of When all three converge at one point, it forms an electric move.