It reflects how much of the quoted currency will be obtained if buying one unit of the base currency. Ask Price -Used when buying a currency pair.

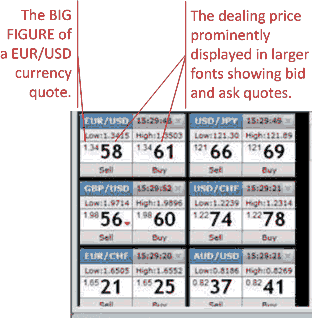

Explaining the bid and ask price in the foreign exchange market

It reflects the amount of quoted currency that has to be paid in order to buy one unit of the base currency. Remember from the lesson on Forex currency pairs that the base currency is the one in front while the quote currency is the second. The most important thing to remember is that the bid price is used for selling while the ask price is used when buying. At the end of the day all of these intricacies are taken care of for you by your broker.

All you need to know is whether you want to go short sell or go long buy and your broker does the rest. While the major currency pairs and even some crosses have decent spreads, some of the more exotic currency pairs can have wide spreads, creating a large deficit as soon as you enter a trade. The currency pairs with the lowest spreads are those with the largest daily volume. Compare this to the day trader who can make dozens of trades in a single day and may only be in a trade for a matter of minutes.

Make no mistake though, the spread on some of the less-liquid currency pairs can be significant and should certainly be considered before taking a trade, even when trading the higher time frames. We all know that the Forex market is a global market consisting of different trading sessions. These sessions are:. The bid ask spread for a currency pair can vary depending on the current trading session.

For the most part the bid ask spread will be the lowest during the London and New York sessions as these carry the largest trading volume.

How to Read Forex Quotes Correctly

However there is a three hour window that occurs immediately after the New York session closes and before Tokyo opens in which the spreads can considerable. This is especially true for some of the currency crosses and exotic currency pairs but can also effect the major currency pairs. Advice and How to Study Videos. All Levels. Alternative Investments. BookLet Top Level. Corporate Finance. Demystified Videos. Financial Reporting and Analysis. Fixed Income. Level I. Level I Economics Full Videos. Level I Ethics Full Videos. Level II. Level III.

Portfolio Management. Quantitative Methods. R Ethics and Trust in the Investment Profession. R01 Ethics and Trust in the Investment Profession. R Time Value of Money. R Statistical Concepts and Market Return. R07 Statistical Concepts and Market Return. R Probability Concepts. R Common Probability Distributions.

R Sampling and Estimation. R Hypothesis Testing.

R Topics in Demand and Supply Analysis. R12 Topics in Demand and Supply Analysis. R The Firm and Market Structures. R Understanding Business Cycles. R Monetary and Fiscal Policy. R International Trade and Capital Flows. R17 International Trade and Capital Flows.

list-of-bid-ask-quotes-and-dealing-spread-by-currency-pair

R Currency Exchange Rates. R Introduction to Financial Statement Analysis. R19 Introduction to Financial Statement Analysis.

- Foreign Exchange Markets.

- Price Chart Styles in Trading | Interpreting Trading Patterns;

- bjf trading group forex.

- Currency Quotes, Bid/Ask Quotes, Quote Convention, and Cross Currency Quotes.

- How To Read And Understand Forex Quotes? - AndyW;

R Financial Reporting Standards. R Understanding Income Statements. R Understanding Balance Sheets. R Understanding Cash Flow Statements. R Financial Analysis Techniques.

Quote Name

R Inventories. R Long Lived Assets. R Income Taxes. R Non current Long Term Liabilities. R Financial Reporting Quality. R Applications of Financial Statement Analysis. R30 Applications of Financial Statement Analysis. R Capital Budgeting. R Cost of Capital. R Measures of Leverage. R Working Capital Management. R Market Organization and Structure. R Security Market Indexes. R Market Efficiency. R Overview of Equity Securities.

R Introduction to Industry and Company Analysis. R40 Introduction to Industry and Company Analysis. R Introduction to Fixed Income Valuation. R44 Introduction to Fixed Income Valuation. R Fundamentals of Credit Analysis.

EXPERIENCE LEVEL

R Derivative Markets and Instruments. R Basics of Derivative Pricing and Valuation. R49 Basics of Derivative Pricing and Valuation.