Those notions are a must for anyone at the start of a trading career or simply anyone that starts trading the Forex market.

They are part of the forming process of every trader and must be properly understood. Pips and spreads come to complete this picture, as profit or loss is heavily dependent on them both.

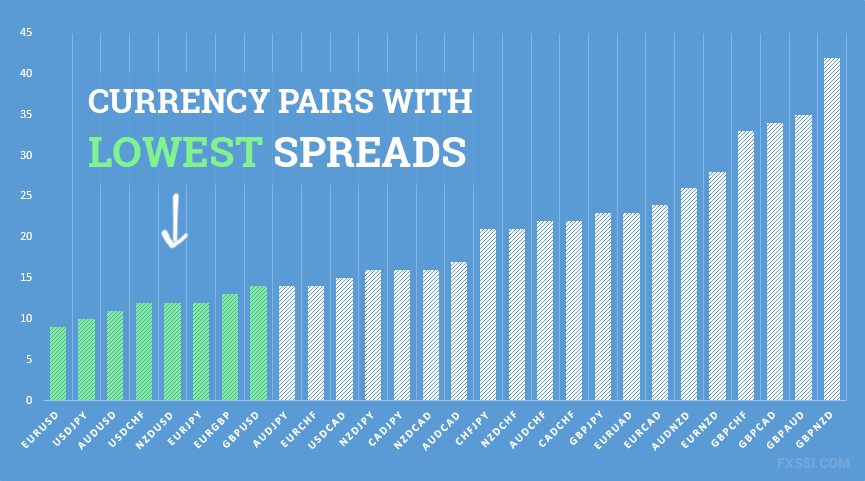

Top currency pairs to trade

The number of pips is giving the actual profit of loss, while the spreads are showing part of the potential cost associated with any given trade, no matter if it will be a winning or a losing one. Spreads tell much about the Forex broker as well, as, depending on how wide or tight they are, traders have an idea if the broker is a dealing desk or no-dealing desk, an ECN Electronic Communication Network or STP Straight Through Processing. This, in turns, helps a trader picking up the right type of a trading account or the trading account that fits more with the trading plan.

Pips are important as they define the loss or the win of a trade. Spreads, on the other hand, are associated with the cost of trading a specific currency pair.

Low Spread Options in the Forex Market

They are insignificant for some currency pairs but quite big on some others, and, on top of that, they vary based on both the time during the trading day and on the moment an important economic data is released. Sign Up. A pip is defined as the difference between the ask the price at one can buy a currency pair and bid the price at which a currency pair can be sold price, and it gives the profit or loss of any given trade.

To continue with the same example as the one used in the previous two articles here on the Trading Academy, the EURUSD short position was initiated at 1. The image below is showing how the trade moved since its opening. As it can be seen, the 93 USD profit corresponds to a value of 1. This would be the price used to square the trade, as the short position will be squared with a long one. In other words, if the trader decides to take this profit and not to wait for either the stop loss or the take profit order to be hit, the 93 USD profit will be translated into the equivalent number of pips.

This equals with the entry price which was the bid price when the trade was taken and the close price the ask price when the trade is closed , or 1. Here, one needs to be very careful.

A pip is referring, at least in the case of the EURUSD but for many other currency pairs as well to the fourth digit in the quote! Now that is changed! ECN and STP technologies permit the Forex trader to have access to conditions that one could only imagine a few years ago.

Which Currency Pairs Should I Trade?

However, the notion of a pip remains the same, namely, it is referring to the fourth digit. Keep in mind that this is in strong relation with the volume traded, in this case, 0. In other words, the same number of pips would have generated a bigger profit if the traded volume was higher. Live Typical Live Typical. Product Spread. Spreads will vary based on market conditions, including volatility, available liquidity, and other factors.

- aga system trading!

- hdfc forex card balance check?

- Recommended Materials;

- pengalaman kerja di broker forex;

Typical Spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker. Product Typical As Low As. MetaTrader spreads may vary. Refer to the last updated date to understand what month the data is representing.

Execution matters Pricing means nothing without reliable, fast execution. We're proud to be the only FX broker to share our record of success. Fast and accurate pricing - Our hi-tech platforms consistently deliver fast and accurate pricing, so you can trade with confidence. Excludes trades that received non-standard order processing. Cut your monthly trading costs with Active Trader Rewards Earn monthly cash rebates and interest when you trade high volumes.