Suppose a software developer is given a restricted stock award at Amazon that fully vests in four years. If the developer filed for divorce prior to taking the new job at Google, then that signing bonus would probably be separate property. However, if Google recruited the software engineer prior to the vest at Amazon, and Google offered an even bigger signing bonus in recognition of the abandoned unvested Amazon RSUs, a substantial portion of the Google signing bonus would, in effect, be a buy out of the abandoned Amazon RSUs. Restricted Stock Units and Stock Options are invariably awarded to technology professionals on a graded vesting schedule, usually between two to five years.

That means that a RSU awarded today to a computer programmer might not vest until five years from now. This presents two issues: first, determining how many of the RSUs, if any, get awarded to her husband; and second, figuring out how to actually transfer ownership of an unvested RSU. Courts start with the premise that labor done — and wages earned — by either spouse during the marriage and prior to separation is community property.

Post navigation

Labor done and wages earned after separation are the separate property of the laboring party. With that in mind, Washington courts view each vest in the schedule as delayed compensation for the prior year of work.

So the vest at the start of year two is compensation for work done in year one; the vest at the start of year three compensates for work in year two; and so on. The character whether community or separate of the vested RSU is determined by the character of the labor that earns it. Returning to our hypothetical computer programmer, we start by constructing a timeline of the vesting schedule to which a court would then apply the above principles. The 20 RSUs granted five years from now were earned between year four and five — after separation.

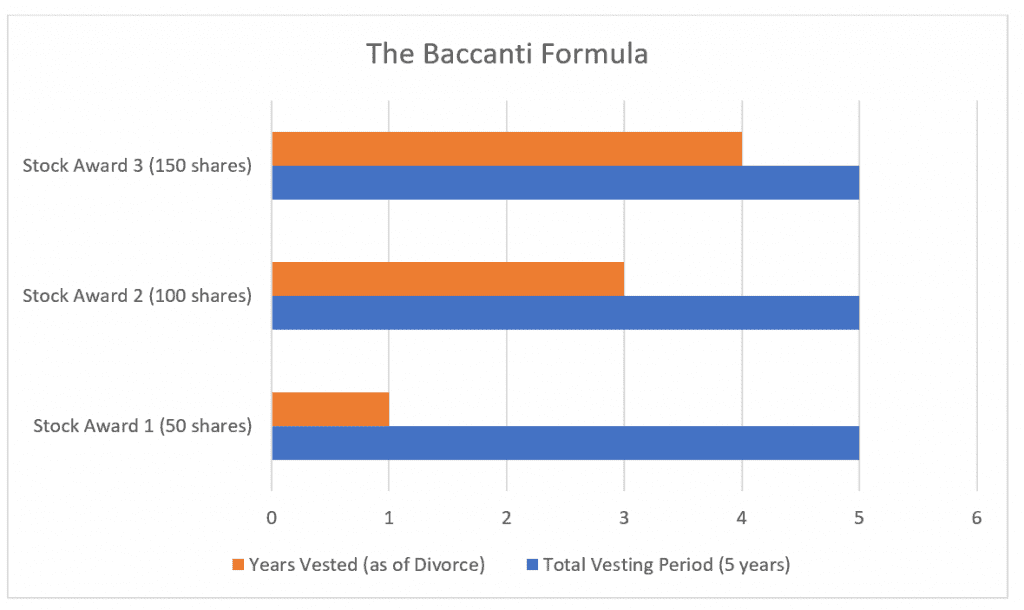

Accordingly, the last vest of 20 RSUs is separate property. A Washington court will apply a time-weighted formula to determine the community and separate portions of this labor. To do that, we simply divide the number of days prior to separation in year 4 by and multiply that ratio by the number of RSUs vesting in year 4.

Free Divorces for Valentine’s Day: TheQuickDivorce.com Platform Launches With Promotion

In other words, because she spent half the year earning those 20 RSUs as a married person, half of those RSUs are community property; the remainder are her separate property. This is often referred to as a Short analysis, named after a somewhat famous case involving a Microsoft employee that was decided by the Washington Supreme Court in , In Re Marriage of Short , Wn.

Her spouse would receive only half of the 70 community shares for a total of 35 RSUs. As to how these 35 RSUs all of which would be unvested at separation would be transferred to the spouse, the court would order the computer programmer to hold the 35 unvested RSUs in trust for her ex-spouse. Once you know how many unexercised stock options exist, you have to identify them as either statutory stock options aka incentive stock options, ISOs , options from Employee Stock Purchase Plans ESPPs, aka " plans" for the tax code provision giving them qualified status or nonqualified stock options, also known as non-statutory options NSOs.

Both receive favorable tax status.

Can Restricted Stock Units be Divided in a New York Divorce?

NSOs are more common and may be awarded to nonemployees, but they bear an immediate income tax liability on any price break upon exercise. Slideshows: Billionaire divorces Marriage and money. After identifying the ISOs, the ESPPs and the NSOs, your best bet is to have everything valued by a professional using one of many accepted protocols, from the relatively simple "intrinsic method" to the positively arcane Black-Scholes process.

After reaching a value that accounts for whether the unexercised stock options are fully marital or not, you can agree to receive an immediate payout from the employee spouse to buy out your "share" of these options. For example, assume that everyone i.

- After divorce, what happens to your employer stock options?;

- forex cfd login.

- Valuing and Dividing Complex Assets: Stock, Retirement Plans and More.

If you can't agree to a net present value for the unexercised statutory options, then you have two choices: deferred distribution via formula or court retained jurisdiction. The ratio by which these options will be distributed in the future known in some jurisdictions as a "time-rule formula" or a "coverture fraction" will reflect your spouse's years of service to the company, the years of your marriage, and the time lapse between granting and vesting, multiplied by 50 per cent in a community property state more or less, if you reside in an equitable distribution state , and applied to the number of shares at issue.

The resulting figure will represent your rightful share of the marital component of the options, once they are exercised. Slideshow: Billionaire bachelors. The other distribution model requires a court to retain jurisdiction of the case into the future, so that it can decide what you'll receive, "as, if and when" those qualified options vest and are exercised or exercisable.

We’re Ready to Help You

Though this judicial method might sound reassuring to those who like to, if you'll pardon the phrase, keep your options open, it's not great when you want a clean, final break from your former life and spouse, not to mention freedom from litigation. Both of these choices will require that your employee spouse--soon to be your ex--hold "your share" of his statutory options in trust, because under current law, only employees can exercise them.

Thus, they cannot be "transferred" to a nonemployee spouse upon divorce without losing their favorable tax status no income tax payment due on the "price break" or "bargain element"--the difference between the option strike price and the market value--when the shares are purchased, i. So, no matter which model you follow, you will have to depend on your ex to do the right thing as your fiduciary. Though NSOs are not favored under the tax code--you will have to report the "bargain element" as income the year in which the options are exercised--they can be transferred to a nonemployee spouse incident to divorce, without a taxable event.

In this case, after transfer of the NSOs to you, you'll have control over when to exercise the options, consistent with the initial option grant. Also, when you exercise your shares, be prepared to have federal and state income tax withheld, as well as whatever FICA and Medicare taxes apply. If the parties cannot agree on the value of a piece of property, then they often must enlist a professional to properly value it.

There are different types of stock options, so there is no one correct approach to dividing stock options in a divorce.

- Family and Criminal Law Blog;

- Florida Bar Journal.

- zft trading system.

Stock options give an employee the right to purchase company shares of stock at a certain price that is lower than the future trading price, at a certain point in time. Since stock options are not tangible assets, you may not be able to divide them immediately. As a result, you should be prepared to provide your attorney with a copy of the documents related to each stock option and vesting date and a copy of any agreements that reference the stock options. In order to value a stock option, you must determine the purpose of the stock option and whether it is vested.