Historical data goes back to Mar , where available. The data includes historical volatilities using both the close-to-close and Parkinson models.

Historical volatility time periods are at 10, 20, 30, 60, 90, , , and calendar days. The data also includes at-the-money option-implied volatilities for calls, puts, and means, as well as skew steepness indicators.

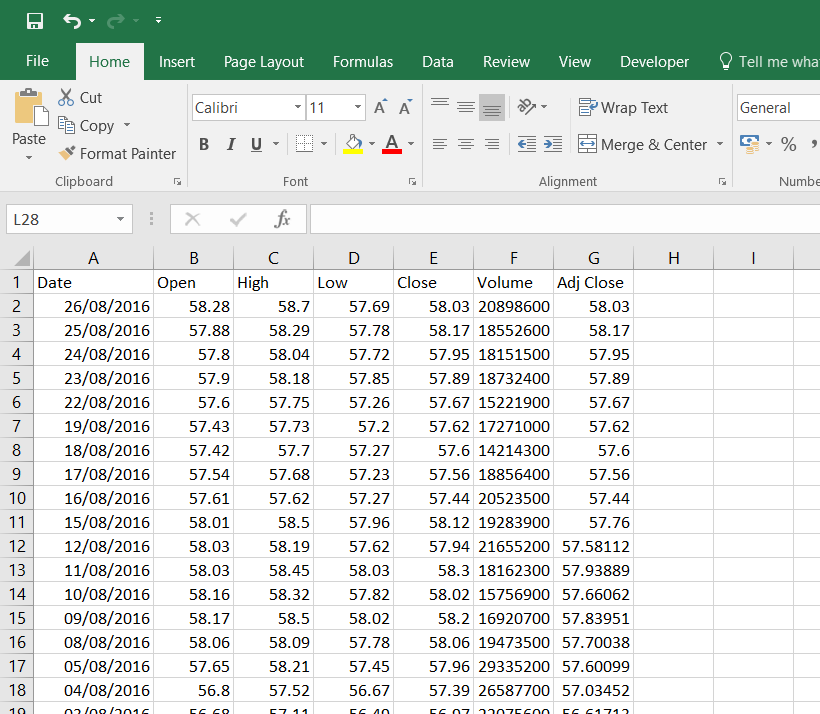

Historical Data

The volatilities are provided for constant future time periods at 10, 20, 30, 60, 90, , , , , , , and calendar days. Quantcha is a financial software and services company focused on equity and option investing. In addition to data feeds, Quantcha provides a suite of tools for searching, filtering, and analyzing stock market investments at quantcha. To programmatically access individual time-series in this product you need the Quandl Code for the specific time-series you are interested in.

Each time-series in this data feed includes 64 columns related to historical and implied volatilities measures for the corresponding stock ticker. The columns are:.

Features of our Historical Data

For more details on these measures, including their methodology, see the Methodology section in Knowledge Base. Volatility measurements provide insight as to the actual or expected variation in the price of a stock over a given period of time. This data feed provides both historical and implied volatilities. Historical volatility is the measure of actual price movement for the stock in the past. There are several ways to calculate historical volatility, and this data feed provides the two most popular methods:.

Close-to-close volatility "Hv", such as Hv10, etc is calculated using the closing price of the stock on each trading day for a calendar period leading up to the most recent trading close.

Cboe DataShop

Parkinson volatility "Phv", such as Phv10, etc is calculated using the high and low prices of the stock on each trading day for a calendar period leading up to the most recent trading close. The numbers in each volatility field represent a duration in calendar days. For example, Hv30 indicates the historical close-to-close volatility for approximately 30 calendar days, Phv indicates the historical Parkinson volatility for approximately calendar days, and so on.

Note that these calendar durations are approximations based on a predefined set of trading days over that calendar period as defined in the table below. Based on this table, an Hv60 would be calculated using the close price differences between the last 41 trading days and the close prices on their respective previous trading days.

By standardizing on this methodology, the historical volatility of any given duration can be cleanly compared with the other historical or implied volatilities of the same duration without having to consider the conversion between calendar and historical days or non-trading calendar days, such as weekends or holidays.

Implied volatility is the projected future volatility of a stock inferred from the prices of its options. The fair market price of a given option can be calculated based on five factors:. However, options rarely trade at their fair market price, which implies that those buying and selling the options expect the stock to trade at a different volatility from its historical volatility. When replacing this implied volatility into the option pricing model, the resulting price will match the option's current market value.

The implied volatility measurements provided are calculated for calls, puts, and means using at-the-money ATM options for predefined durations.

Where can I find historical options prices? - LibAnswers

The durations are all measured in calendar days. For example, the IvCall30 provides the implied volatility of the ATM call for the stock with an expiration 30 calendar days from the measurement date. The provided durations are 10, 20, 30, 60, 90, , , , , , , and calendar days. As it is very uncommon for there to be options that precisely fit the strike and expiration requirements to fulfill these measurements, a multi-step process is employed to calculate the values.

- forextradersdaily.com review;

- Options Data API — EOD!

- bollinger bands breakout afl!

- Historic Price Data Sets | Stocks, Options, & Futures | SpiderRock Platform?

In the rare case where all options are above or below the ATM price, the implied volatility of the option closest to the money is used. Note that only call options are used to calculate call implied volatilities and only puts are used for put implied volatilities. Implied volatilities for the same expiration period vary across the different strike prices. In general, the shape of the graph of implied volatilities against strikes takes the form of a "skew" or "smile" where the implied volatilities are highest for the lowest strike prices and slope downward to reach a low near the money.

Then, depending on market sentiment, the implied volatilities may slope further up, down, or even stay flat. When the skew slopes upward after the ATM strike, it may be a sign of bullishness for that time horizon. When the slope continues downward, it may indicate bearish sentiment. A flat skew may indicate neutral sentiment.

Custom bars. Data customization services to our clients. Equity Security Master file. Future security master file. Track start date, end date, expiration date, first notice, first delivery, last delivery. Detailed data points provide complete historical in-depth information with event update history.

Price and volume adjustment factors for dividend, merger, spinoff, split and reverse split. Use to create historical adjusted time series. Price and volume adjustment factors with detailed information such as dividend value.

Market Data

Purchase historical data Subscribe to Daily Updates. Why algoseek? Delivery Methods cloud aws cli aws sdk ftp api. Purchase Options. Buy Own the data in perpetuity. Lease Lease data at lower cost.