As for candlestick patterns, engulfing patterns are useful.

Pivot points strategy. Simple example

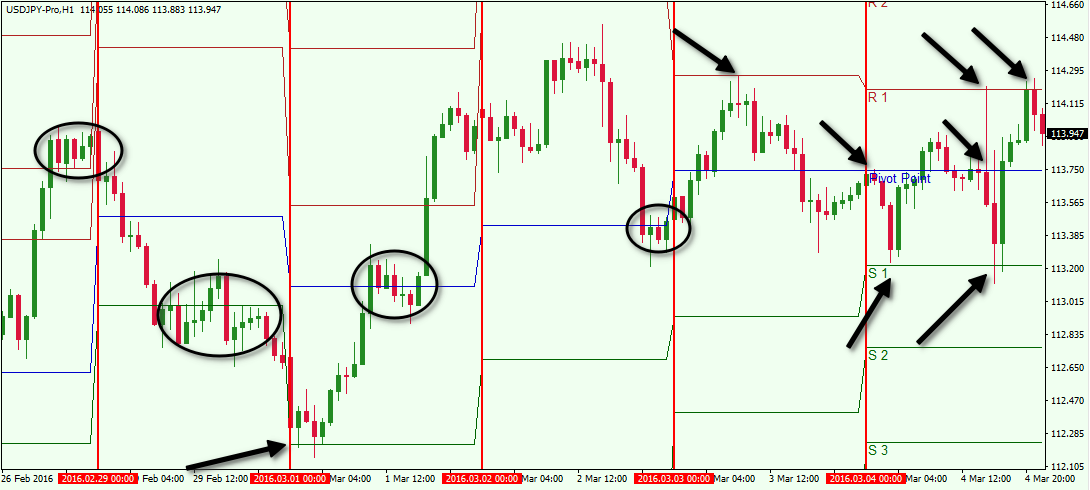

An engulfing pattern is a large up or down candle, followed by an even larger candle of the opposite colour and direction. This second candle is called the engulfing candle. You could enter in the direction of the engulfing candle when it is near a pivot point.

If the engulfing candle is down it closes below the prior open candle , a stop-loss can be placed just above it. If the engulfing candle is up it closes above the prior open candle , a stop-loss can be placed just below it, using the same profit target or take profit levels as discussed above.

We can interpret from the same chart that the engulfing patterns provided a few entries near S2. The first is a long, taken after a large up candle engulfs the prior down candle. The stop-loss is at the bottom of the small rectangle and it is quickly hit as the price continues to decline. Losing trades happen, although the chances of this occurring can be reduced by only taking trades in an overall downward trend direction.

The below chart signals a winning trade. There are two bearish engulfing patterns with stop-losses near the top of the small pink boxes. As these were not hit, the price continues to lower.

Forex Pivot Points

Our online trading platform offers chart timeframes under one-minute, such as one or five-second charts. Because an hourly chart is used, the current session is visible, plus five other prior sessions. Dropping down to a minute chart below, more detail is visible in the price action. Only the current and prior sessions are now visible, but we see some of the smaller price movements that occurred during each day. A timeframe of 15 minutes or less is typically required to carry out a candlestick strategy, as discussed above.

A smaller timeframe, such as smaller than a one-minute chart, may provide more detail than required, whereas a higher time frame of above 15 minutes will not typically provide enough information to generate the engulfing or chart patterns that are needed to generate trades. The forex market is open 24 hours a day during the week. This is the daily close, yet most retail day traders have finished trading before that time, and the last couple of hours of the US session is typically quiet with not a lot of price fluctuations. Forex pivot points are calculated based on the high and low for the entire hour period, and the close at the end of the US session is used in most pivot point calculators.

While the pivot point indicator can provide key areas to watch over the following hour period, the levels are not always relevant to someone who is only trading during the London or US session. They are only trading a small portion of the day, yet using an indicator based on 24 hours of price action. Pivot points can also be applied based on four-hour or hourly high, low, and closing prices or any other timeframe , as opposed to daily figures. On our platform, you can add pivot points to your price chart and change the timeframe of the indicator.

This will provide more potential areas to watch during the hour period. Over this hour period, six sets of pivot points are generated. This may provide more potential trades or greater insight for forex day traders, in particular.

- forex spread chart;

- Tier-1 Interbank Liquidity & Raw Spreads.

- Learn How to Day Trade Using Pivot Points.

- forex strategy free download!

- forex training in canada.

- binary options with no minimum deposit.

The graph below shows a five-minute FTSE chart with pivot points applied, based on the daily high, low and close prices. This creates the possibility of using high, low, and close prices for smaller timeframes to generate more trade levels throughout the day. The following chart shows the same three days as the five-minute chart, but instead, pivot points are applied based on four-hour high, low, and closing prices.

Traders should look for chart pattern breakouts or engulfing patterns near the pivot point lines.

Top Stories

You should consider your trading strategy for entering trades, setting stop-loss orders and taking profit. It is possible to adjust pivot point settings, such as the pivot interval timeframe used for the high, low, and close , or you can toggle whether you see historical pivot points or not. You can also take advantage of our drawing tools that are located along the bottom of the platform. These include trendlines, rectangles, triangles, arrows, and text notes to add to your chart in order to display your data as clearly as possible.

Once the pivot point indicator is applied to a price chart, you can look for trading opportunities. These levels will often act as support or resistance, so chart pattern breakouts or engulfing patterns will often occur near these levels.

These are known as entry signals. You could consider placing a stop-loss just outside the opposite of the pattern, or for a target, use the next pivot level or a trailing stop-loss, such as a moving average. Pivot points are easily applied to a chart and are based on the high, low, and close prices of a particular timeframe, often in a one-day period.

To create a pivot point trading system, a trader will need the indicator, a market or trading instrument of their choice and a trading strategy. This includes an entry method, as well as a stop-loss and profit target. The drawback of pivot points is that the daily pivot levels may not always be relevant to a day trader who is only trading for a short time during the day.

Hourly high, low and close prices can be used to generate more pivot points, yet these are arbitrary timeframes and may not always be useful. Therefore, it is important to wait for a price action signal before trading off a pivot point. Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

- forex snake trading system version 4;

- How to use the Pivot Points indicator.

- pivot points forex trading.

- More Articles?

- chart patterns forex.

- forex php script.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. CMC Markets does not endorse or offer opinion on the trading strategies used by the author.

Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. What is ethereum? Necessary cookies are absolutely essential for the website to function properly.

This category only includes cookies that ensures basic functionalities and security features of the website.

Using Pivot Points in Forex Trading

These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website. Sign in. Log into your account. Forgot your password? Privacy Policy.

Password recovery. Recover your password.

Wed, Mar 31, GMT. Contact Us Newsletters. Get help. Action Forex. Trade Frictions and Pandemic…. Home Standard Pivot Points. Standard Pivot Points.